As Lido TVL nears an all-time high of $40 billion, LDO’s value has hit a critical juncture.

Ethereum-based liquid staking Lido has seen a 25% increase in total value locked (TVL) over the past 30 days. As a result, Lido TVL is on the verge of reaching the $40 billion peak reached in March.

Despite its rise in scale, Lido DAO Token (LDO), a native decentralized finance (DeFi) project, may find it difficult to continue to appreciate. This is the reason.

Belief in standing at the ends of the march on the lido circles

In November, Lido's TLV was $24.60 billion. TVL measures the value of the total assets locked or stored on the blockchain. When the TVL is high, the flow of assets is locked into the platform.

This development often improves liquidity, increases user confidence, and increases demand for the platform's native token. On the other hand, a decrease in TVL indicates an increase in asset outflows, indicating less investor confidence.

According to DeFillama, the protocol's total value locked (TVL) is currently $38.57 billion, just shy of its all-time high of $2 billion. This development reflects renewed confidence in Lido's ability to offer competitive products.

This increase corresponds to a 10% increase in the price of LDO in the last 24 hours. The rally could be attributed to the grayscale Lido Dao Trust, indicating that institutional investors can now gain exposure to the cryptocurrency.

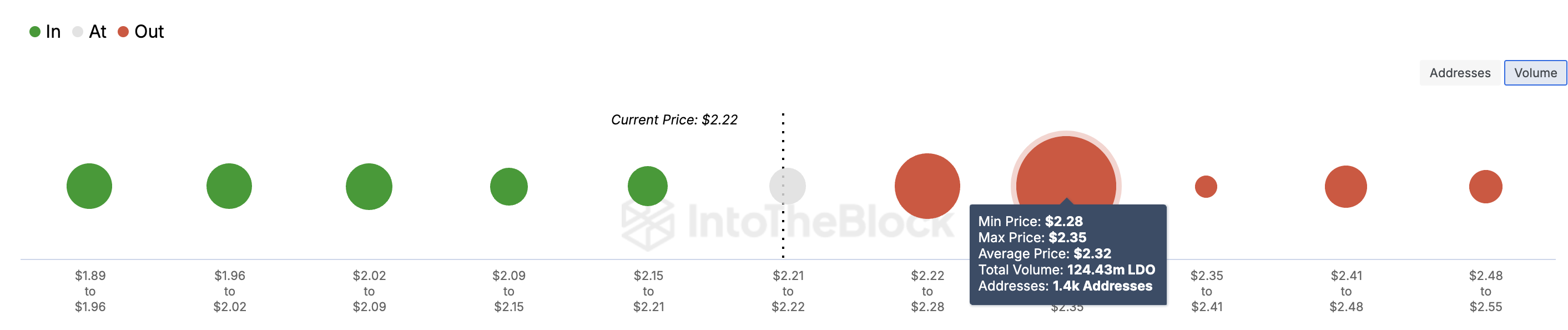

However, Money Around Price (IOMAP) noted that it may be challenging for the altcoin's price to rise to the $3 mark. This is because there is strong resistance around $2.32.

For context, IOMAP categorizes addresses into in-the-money, out-of-the-money, and addresses based on breakpoints. When there is a large amount of tokens in the currency, it indicates resistance, and a large cluster of the currency indicates resistance.

As shown above, about 1,400 addresses hold 124.43 million and are stored at an average price of $2.32. This amount is higher than those bought between $1.89 and $2.22, which shows strong resistance around the current price. In this case, the LDO can experience significant backlash.

LDO Price Prediction: Altcoin Eyes Low Levels

From a technical perspective, the Awesome Oscillator (AO) on the daily chart is positive. However, the AO that measures the velocity has lit red histogram bars. The red bars on the AO indicate that the velocity around the LDO is decreasing.

Like AO, Moving Average Convergence Divergence (MACD) also supports a bearish view. Typically, when the MACD is positive, it means the momentum is bullish.

However, in this case, a negative reading suggests that the price of LDO may drop to $1.65. This price is at 61.8% Fibonacci retracement indicator.

If buying pressure increases, which is unlikely, LDO could rise to $2.38. If this consolidates and Lido TVL's peak is passed, the altcoin could exceed $3 in a short period of time.

The post LDO price hits critical moment as Lido TVL nears $40 billion all-time high appeared first on BeInCrypto.