Ave rises to 5-month high as Bitcoin tests around $62k.

Ave reached a five-month high of $143, up 14%.

Bitcoin soared above $61,800, rising 4% amid new crypto resistance.

Ave continued to outperform its peers, surging to its highest level in five months on Aug. 21. Meanwhile, Bitcoin's price broke above $61,800, up 4 percent in 24 hours.

AAVE rose 14% to reach a 5-month high.

Decentralized finance (DeFi) protocol Aave (AAVE) was among the top gainers on Wednesday, rising more than 14 percent to $143. Aave's native utility and management token has reached its peak during a period of high whale activity over the past few days.

It was positive news for Aave after DeFi project Aave V3 was deployed on the ZKsync Era Mainnet.

Aave V3 is powered by @zksync on the Era Mainnet and is unlocking unprecedented scalability, privacy and security for the DeFi user base and new institutional use cases. pic.twitter.com/blNlUjsalX

— Aave Labs (@aave) August 21, 2024

AAVE value prediction

Rising above $143, Aave's price has moved to its highest level since March 2024. This is when Bitcoin rode the semi-mania and reached an all-time high as the currency we trade BTC.

AAVE's push to current levels means the altcoin could see fresh gains in the $177-$200 price area. However, the rise in AAVE price also saw a flash of a sell signal on the daily chart.

Crypto analyst Ali Martinez shared this price view with AAVE earlier in the day.

The last four times TD Sequential has flashed a sell signal on the #AAVE daily chart, it has seen an average correction of 27%. A similar sell signal is now showing, suggesting that $AAVE may decline. pic.twitter.com/12yZwLT5tp

— Ali (@ali_charts) August 21, 2024

Bitcoin bulls are aiming to break above $60,000

While Bitcoin has struggled to recover since the brutal selloff in early August, bulls remain undeterred. Buyers showed great commitment in their efforts to raise over $60k.

Over the past 24 hours, the benchmark crypto has broken above this critical level and currently looks set to extend some of its gains.

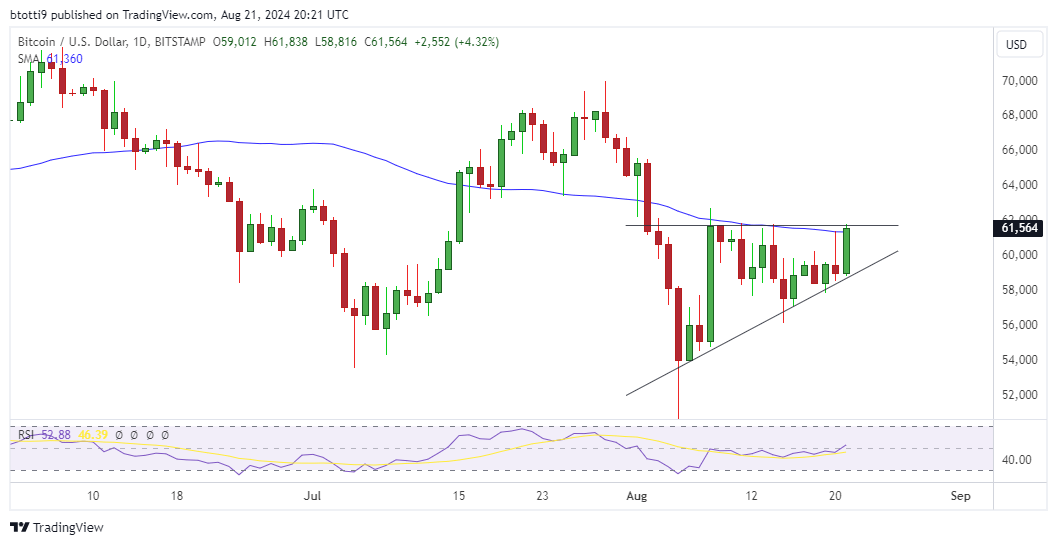

BTC hit an intraday high above $61,838 on top crypto exchange Bitstamp.

BTC chart

The upside highlights the formation of an ascending triangle pattern with the BTC/USD pair touching its 50-day simple moving average. In technical analysts, the rising triangle is like a bullish chart pattern and the resistance level follows the horizontal line.

Meanwhile, the swing lows follow the rising trend line which forms a narrow triangle when price looks like it will resolve to the upside.

Bitcoin's daily chart suggests that this has been the case for BTC since it dropped to $49,577 on August 5. In particular, the 50-day SMA currently acts as a strong barrier. If the bulls break sharply, the price may target the key supply wall around $68,255.

However, if the weakness rebounds, the main support area could be around $58,266 and then $55,800.