Bitcoin ETFs hold 5% of the total supply of 1 million BTC

Bitcoin exchange-traded funds (ETFs) have hit the big time. They now hold over 1 million BTC, which represents nearly 5% of Bitcoin's total supply.

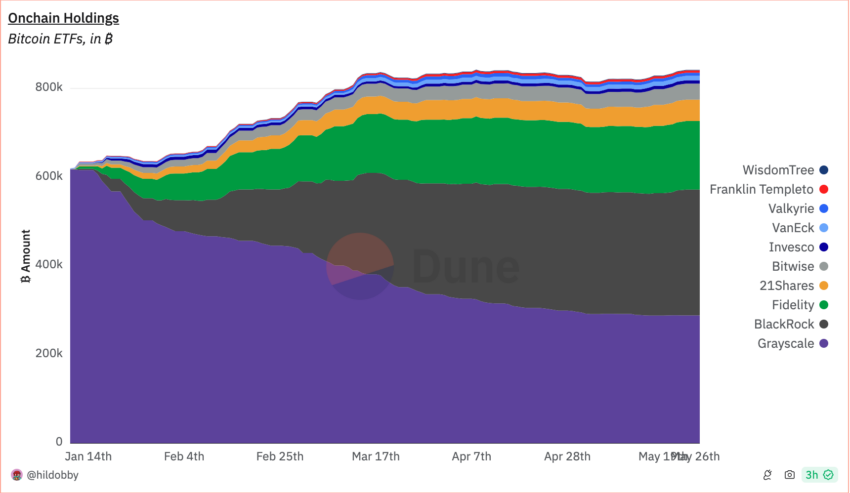

Grayscale and BlackRock, with their BTC assets, are leading this sector, highlighting the growing institutional interest in cryptocurrency investments.

Bitcoin ETFs hold more than 1 million BTC

As of May 23, ETF holdings totaled 1,057,039 BTC. Greyscale's GBTC leads at over 291,000 BTC, closely followed by BlackRock's IBIT at 279,500 BTC. Recent data from Arkham Intelligence shows an increase: GBTC now holds 293,000 BTC, while IBIT has 284,526 BTC.

Read more: How to trade Bitcoin ETF: A step-by-step approach

Outside the US, Germany-based BTC Bitcoin Exchange Traded Crypto (BTCE) is the largest holder with 22,490 BTC. Swedish ETFs, Bitcoin Tracker Euro (COINXBE) and Bitcoin Tracker One (COINXBT) manage 17,830 BTC and 14,580 BTC respectively. Seven newly launched Bitcoin ETFs in Hong Kong have 5,789 BTC, although investors still have to be paid interest.

Hashdex, a key player in the ETF market, holds more than 7,900 BTC through its HASH11 fund in Brazil. The company's influence extends to the US with its 185 BTC Bitcoin ETF, DEFI.

US ETFs dominate the market.

The data clearly shows that US ETF issuers are leaving asset managers from other countries behind. Michael Saylor, a famous Bitcoin advocate, highlighted these holdings. On May 24, the US ETF held 855,619 BTC, while the Global ETF held 1,002,343 BTC.

“32 Bitcoin Spot ETFs now hold ~1 Nakamoto of $BTC,” he said.

Assets under management data for US ETFs shows that Grayscale dominates, although market share has declined slightly. BlackRock and Fidelity maintain steady market shares. Other players such as WisdomTree, Franklin Templeton, Valkyrie, VanEck, Invesco, Bitwise and 21Shares have a smaller market share, showing moderate variation.

Read more: Bitcoin price prediction for 2024/2025/2030

The stability and growth of EFs are the drivers of investor confidence and trading volumes. The launch of spot bitcoin ETFs led to an increase in trading during US market hours, accounting for 46% of the total volume from January to April, according to Caico Research. The trend continued, with ETFs experiencing the highest net inflows in 10 weeks this past week.

ETF stability and growth are not only indicators of investor confidence, but also drivers of trading volumes. The launch of spot-bitcoin ETFs led to an increase in trading during US market hours, accounting for 46% of the total volume from January to April, according to Caico Research. This trend continues, with ETFs experiencing the highest net inflows in 10 weeks.

Bitcoin price hovers at the psychological level of $70,000. From January to April 2024, BTC returned 57%, outperforming the S&P 500.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.