Crypto.com Needs National Trust Bank License – What Changes?

Crypto.com in cooperation with the small trust bank charter required to help the federal recognition of the American currency (conference (conference) in connection with the conference (conference (conference)) to carry out the company.

The agreement to expand the footprint of financial services established in the United States indicates that it is a long-term move.

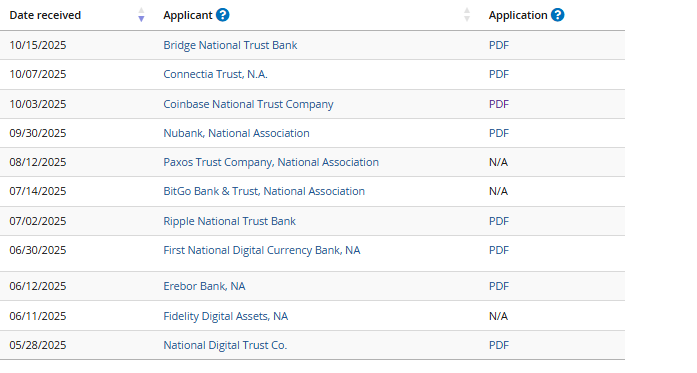

Crypto.com joins a growing list of heavyweights pursuing a federal charter

In the announcement, Critpto.com said: – The charter will allow them to grow their protection and driving technology while providing services on multiple channels, including the domestic Kronos network.

The company emphasized that the federal license ensures that it is a trusted legal destination for digital asset treasuries (ECEPS) and institutional investors.

Chris marsszelene, the

Markulelek described the new filter as a safe, reliable, and institutional-friendly Comppto infrastructure.

Now Crypto.com will marry CONINBEABE, circle, circle, circle, circle, circle, circle, tea, and other similar applications.

Anchor Digital Bank is the only company to hold a federal trust charter. The company mentioned the license in the license, but the challenges that led them to take a temporary and promising order in 2022 were improved later in August.

Why are multinational companies fleeing to secure national bank charters?

The incorporated agency, which operates as an independent office within the U.S. Treasury, is the only agency authorized to issue national bank charters.

These licenses allow companies to operate banking and securities services in all 50 states under one legal framework.

For digital asset payments, digital value companies, the privacy charter has been seen to legalize, including the federal protection of payment systems, they have provided the provision of the complicated purchase regulation.

In contrast to the traditional banking license, the National Trust Bank Charter prohibits them from accepting loans for specific or general purpose activities such as asset protection and investment management.

This structure allows them to exist outside of the banking system, rather than having the distribution of federal record control, even though they are under the control of the fan.

Following this license, the copy of CRUPTo's number of back stories showed appreciation for the movement of digital assets.

According to Jonathan Goad, a former regulatory executive, he has given new instructions to local banks to buy, sell and pay scrips.

After recent months, it has been given a conditional approval to re-approve the conditions of the EREBABUB bank held by Peter Annette and Palmer Lukaki, who are willing to test the Vidpio banking models, which will be taken back to Erborbor Bank.

They have officially stated that the blanket barriers that occurred from 2023 “occurred in the banks.

This week, the arrivals did not accept the fears by calling the sudden mixed danger and risking accumulated journeys.

Federal Charters (Banking Procedures) Federal Charters clear args rose prypto tarps to stop applications

Still, the path to a federal charter remains straightforward. Those found have received more than 16 applications from fintechs and citizens seeking national trust status, but only one has been approved so far.

Many of the traditional banking groups are held and argue that the national trust has yet to meet the expected advertising standards.

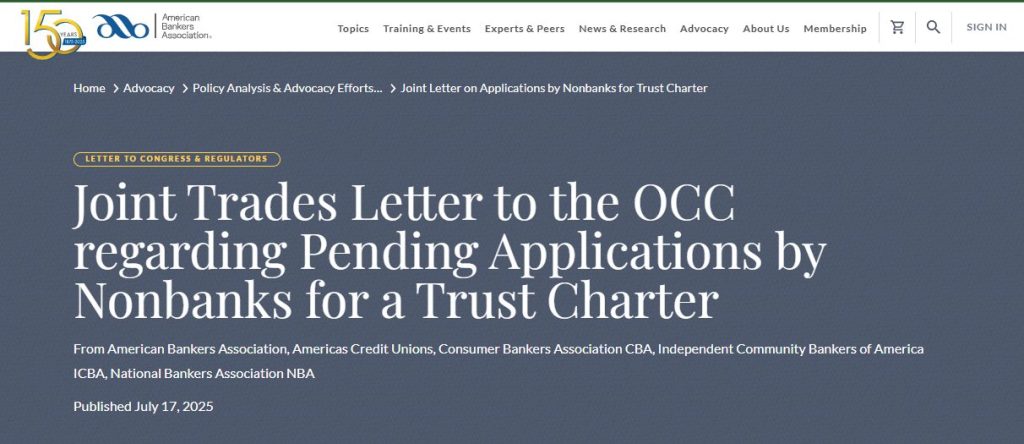

In the year In July, the American Bankers Association (ABA) joined another banking and credit union, sending a letter to the viewer to stop the related charter compilation.

The group offers prison and driving services rather than traditional on-demand activities, such as Riprel and Circle.

The letter says that silencing such applications represents a “fundamental withdrawal” and praises the security measures that run the US banking system.

Regulatory caution also dictates broader concerns over anti-money laundering (AML) treatment and risk transparency.

Applicants must demonstrate strong governance, capital efficiency and internal controls before being accepted.

While the agency is more open under Gedg's leadership, critics remain slow to test new regulatory models for digital asset institutions.

Closing news news analysed, cryptographic predictions

![[Live] Crypto News Today: Latest Updates For Nov. 25, 2025 – Bitcoin Holds Above $87K In Broad Market Rebound; Glassnode Flags Oversold Conditions With Early Signs Of Recovery](https://coinsnewsdesk.com/wp-content/uploads/2025/11/Latest-updates-for-N-Novel-25-2025-300x200.jpg)