Ethereum ETFs are rising while Bitcoin ETFs see major outflows.

Ethereum ETF's returns outpace Bitcoin ETF's returns. BlackRock's iShares Ethereum Trust ( ETHA ) ETF leads on December 23, 2024 with $89.51M in revenue. This market shift could herald the altcoin season of 2025.

Surprisingly in the cryptocurrency market, Ethereum spot ETFs are experiencing significant inflows, which have eclipsed the inflows seen in Bitcoin ETFs.

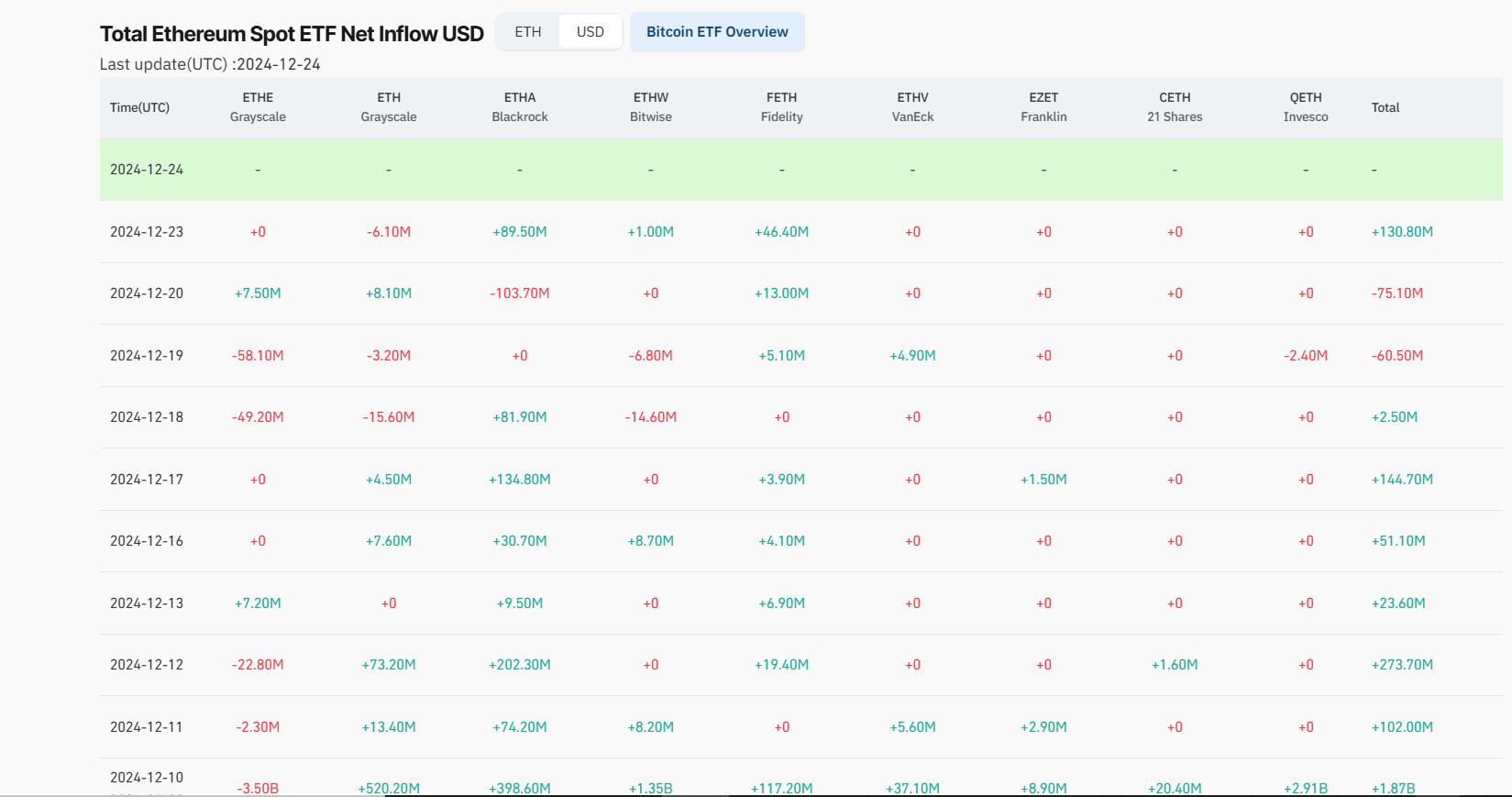

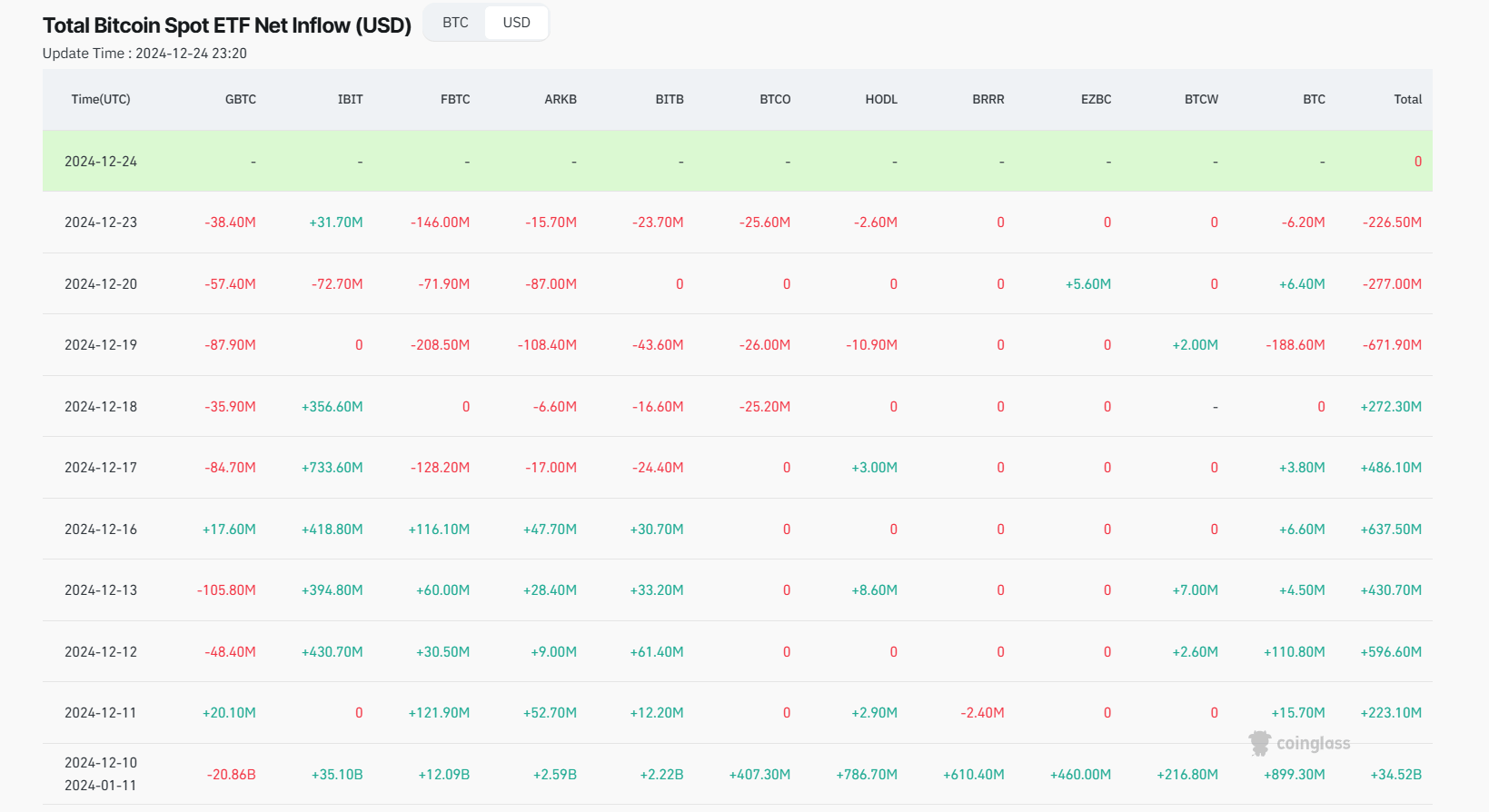

In the year As of December 23, 2024, Ethereum ETFs recorded net income of $130.8 million, led by BlackRock's iShares Ethereum Trust (ETHA) ETF with $89.50 million and Fidelity's Ethereum ETF (FETH) adding $46.40 million, according to Coinglass data. In contrast, Bitcoin ETFs saw a total of $226.50 million spent on the same day.

This trend has been consistent in recent weeks. For example, on December 12, Ethereum spot ETFs had a cumulative net income of $273.70 million, continuing their 14-day streak of positive earnings. The BlackRock ETHA ETF alone saw a one-day net inflow of $202.30 million, while the Grayscale Ethereum ETF (ETH) contributed $73.20 million.

The shift indicates that the altcoin season may begin

Bitcoin ETFs have been facing outflows despite high trading volumes, suggesting that investor sentiment may be shifting to Ethereum.

Market analysts speculate that this could signal the start of the ‘altcoin era', with investors expanding their portfolios beyond Bitcoin, with ETH leading the pack.

This shift in investment flow is particularly notable as it came at a time when Bitcoin was dominating headlines with its price performance, reaching over $108,000 in early December.

The main reasons for this trend are Ethereum's growing ecosystem, especially decentralized finance (DeFi) and non-fungible tokens (NFTs), which may attract investors looking for dynamic growth opportunities.

Additionally, the regulatory environment under the incoming administration could be considered more favorable to Ethereum, which has a wider range of usage applications than just being a store of value like Bitcoin.

This development raises questions about the future direction of crypto investments. While Bitcoin has been the bellwether of the crypto market, Ethereum's recent performance in the ETF space may hint at a rebalancing of investor interest, which could lead to more balanced growth across various cryptocurrencies in 2025.