Gold and silver just ends the unusual Bitcoin price tag

Although some Bitcoin analysts refer to Bitcoin as digital gold, the physical precious metal can be a good way to predict future price movements.

When a Bitcount traders explain their point to secrecy, run the BTCCoin / gold nest.

Sponsored Sponsored

Many stories of stars

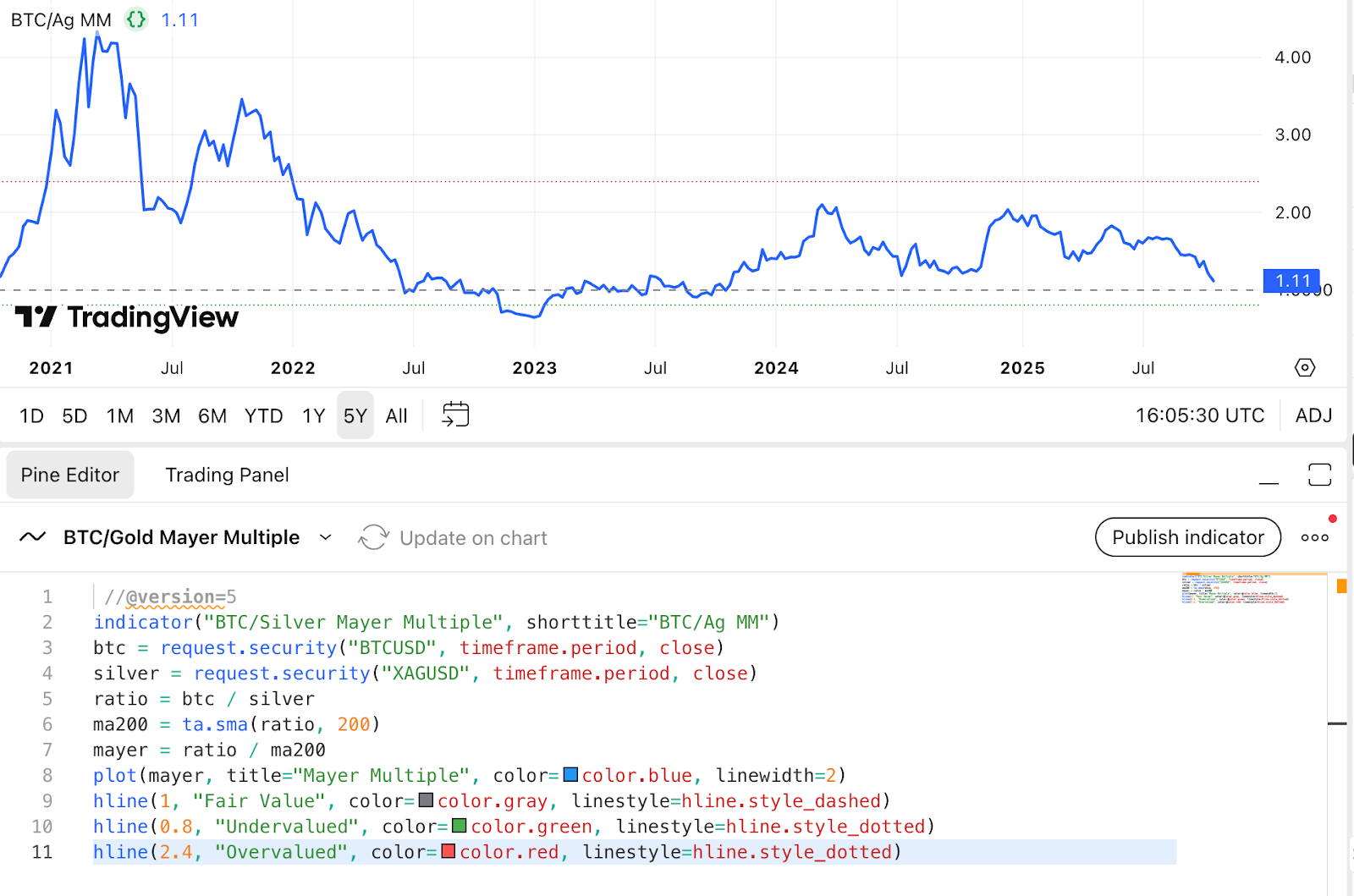

Compare bitcoin to gold ratios through the 2000-day movement, and the affiliates of this indicator believe that bitcoin will rule if it puts one less than 1 from Lips.

The user of X said that the ratio must-dips, indicating the possibility that it is only during Bitcoin crashes.

However, it is good to see how the price of gold and Bitcoin fares before investors are confident in the trend. We will also discuss how to predict the way silver prices will move next.

The center of this opportunity is a common indicator with BCC / Gold Mayor, so it is good to know how it is.

An entrepreneur and a financial scientist, Doka Management has managed to track the historical price movements of the beacon, which allows him to find opportunities and realize opportunities.

It calculates the current price of Bitcoin with a 200-day moving average.

For example, if it is now worth $120,000 and $120,000 and 2,000 days, it has a lot of 1.2 May.

Sponsored Sponsored

A ratio greater than 2.4 indicates that Bitcoin is more.

የ “X ተጠቃሚ” እንደ << <>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

Like all other indicators, others are based on quoting indicators and historical patterns to predict future price movements.

How will gold and silver prices affect Bitcoin?

For an extended period of time, when gold or silver prices rise more quickly, it often indicates that Bitcoin is ready to run again.

Sponsored Sponsored

This relationship is in BTC/Gold Mayber Multiple and BTC/Silver Mayber Multiple. Both of these indicators are based on the 200-day moving average.

Less than 1 is greater than one

example-

BCCP Gold Mathews In November 2022, it decreased a lot. March 2020 and 0.85 near the Bitcoin market. The price of Bitcoin will more than double in the following months. BCC/Iron Michaels reached a high of $1,900 before falling to around $60,000 before hitting a high of $1,990 before hitting a high of $1,924 less than 1 year ago.

More recently, the BTC/Gold pair briefly fell below 1 at the end of October. Small dips even below the rule, such as 0.98 cycles – have been proven to provide strong entry points for long-term investors.

Sponsored Sponsored

In short, the ratio between Bitcoin and the precious metal has been below 1 since the beginning of the historical “buy-to-reach” window.

What do gold and silver prices mean for Bitcoin?

Both gold and silver bullishes currently point to a bullish outlook for Bitcoin. The idea is simple: if he trades the precious metal for a long time, when the constant volatility of bitcoins comes, and then he will hold them heavily.

So far, gold is 54%, silver is 63%, and Bitcoin is 21%. If the sound of history supports it, Bitcoin will soon relax that segment and provide the returns achieved in the coming months.

For a long time, the performance of the bikini speaks for itself: while in the river and silver, gold and silver have doubled.

Beyond the many signs of the mayor, the macro picture also supports Bitcoints upwards, low interest rates, Pro-Computoiness ons-comment are creating the right conditions for the re-investment.