How buying Ethereum whales affects the price of ETH

On-chain data shows that Ethereum whales are buying heavily in anticipation of a possible price increase.

A crypto-wealth is an individual or entity that owns a significant amount of a specific digital asset. Over the past week, on-chain analysts have identified a number of wallets capitalizing on price volatility to buy Ethereum.

Ethereum collects wells

On January 5th, Spot On Chain spent $48 million to buy 21,192 ETH at an average price of $2,265 per coin. The whale, which started its buying spree last January, acquired nearly 80,000 ETH, mainly from decentralized exchanges (DEXs) and Binance, at an average price of $1,790.

These purchases were made with loans from DeFi protocols Aave and Liquidity, with high speculation on ETH's future price increase. Meanwhile, the whale investment posted a significant 26 percent return of over $36.84 million.

Read More: How Vitalik Buterin's Roadmap Update Could Push Ethereum To New All-Time Highs

LookOnChain has also identified two whales that have acquired large amounts of Bitcoin and Ethereum following their recent price drop. According to the analyst, these entities bought a total of more than 1,300 ETH at $2,225.

Blockchain analytical company Sentiment also confirmed that Ethereum, the largest self-sustaining wallet, is accumulating the largest cryptocurrency at a “fast pace”. 150 of these wallets hold more than 56 million ETH, the highest ever, according to the firm.

“In particular, the large ETH non-exchange whales are gathering rapidly while the exchange whales remain low,” Santiment added.

What is next for ETH price?

The increase in whaling activity has fueled speculation that Ethereum's price may rise further in the future.

“Ethereum Support and Resistance Revealed! All eyes are on the Bitcoin Spot ETF, but little do you know that ETH will soon have a Spot ETF! The price is still low,” wrote technical analyst CryptoBusy.

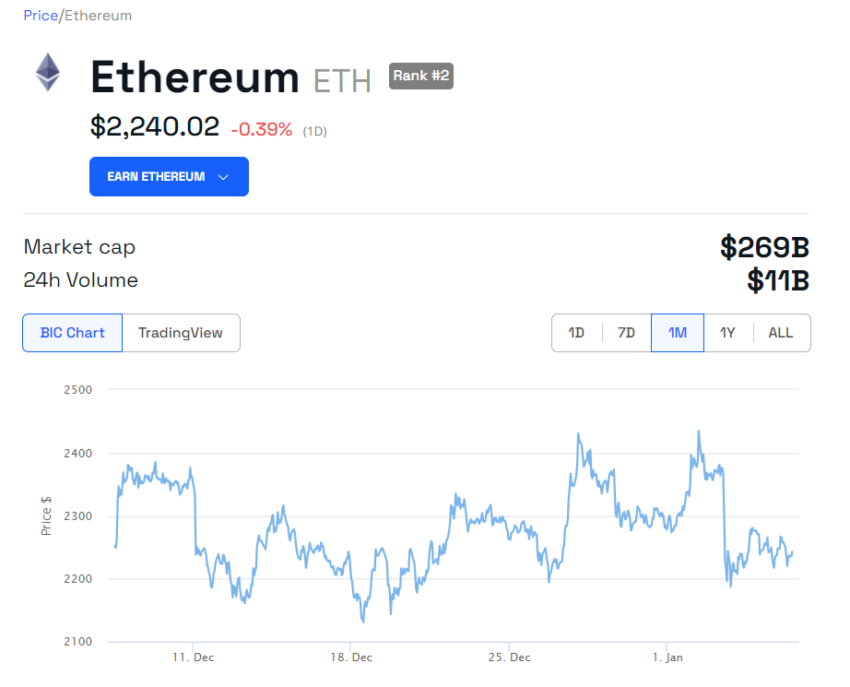

BeinCrypto's pricing data shows that Ethereum has maintained stability above the $2,150 mark since the beginning of the year, trading around $2,240, down 0.39% in the last 24 hours. However, the asset is down 2.5% in the past seven days.

Over the past year, Ethereum has seen relatively poor price performance compared to other assets such as Solana. It posted a modest 90% gain compared to the triple digit increases seen in BTC and SOL. Thus, ETH is down more than 50% from its 2021 all-time high of $4,864.

Read more: Why Ethereum is bound for big gains in 2024

Despite the low performance, market analysts maintained positive predictions for the price of ETH. Asset manager Van Eyck predicts that Ethereum's price could exceed $50,000 by 2030.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.