How to hold DYDX Token

Decentralized finance (DeFi) platforms are constantly evolving, bringing new financial solutions and increasing security through distributed systems. An important part of the DIDX chain's functionality is its staking mechanism: like other proof-of-stake consensus mechanisms, it maintains and stabilizes the chain by actively involving the community in governance and consensus processes.

This article provides a guide to placing DYDX tokens on the dYdX chain, from understanding the basics of stocks to managing and optimizing your positions.

The importance of keeping on the DIDX chain

Staking in the context of blockchain technology involves holding funds in a cryptocurrency wallet to support the operations of the blockchain network and receive rewards. In many Proof of Stake (PoS) mechanisms, staking contributes to the security and efficiency of the network. Users hold their tokens for the right to participate in managing the network, including voting on protocol changes and verifying transactions.

dYdX Chain uses the Cosmos SDK Staking module, which supports the PoS blockchain and allows DYDX holders to become validators and/or give their DYDX shares to the DIDX chain validator.

For DIDX, chain staking is not only a measure to secure the network, but also a way to reward stakeholders. Stakers help decentralize the validator pool to improve the decentralization of the network. In return, you will receive substantial rewards that are primarily generated from trading fees generated by the platform.

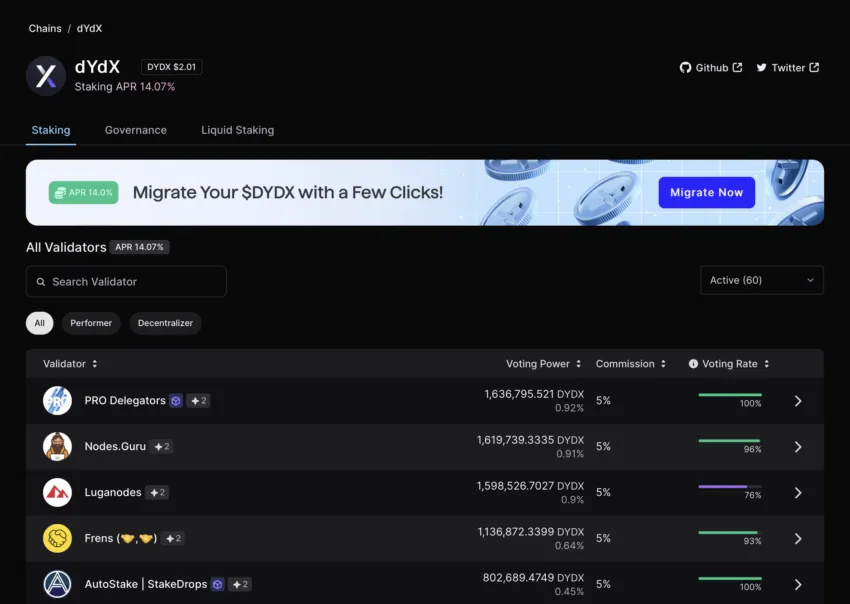

dYdX distributes 100% of protocol fees to stakeholders in USD instead of native token. As of today, the protocol has allocated $24.6 million to more than 21,000 stakeholders. According to Mintscan, the current APR for DYDX stands at 19.45%.

How to handle DYDX

The process of depositing DYDX tokens involves several key steps:

Pinching

Staking DYDX tokens on the DYDX chain is key to securing the network, rewards stakeholders with USDC rewards, and allows the community to participate in governance. Connects directly to the DIDX chain, allowing for both standard and fluid retention options. Staking is also available through Ledger Live, Leap and Anchorage. There may be additional stock providers to choose from over time.

Keplr is a blockchain wallet that is not accessible through a web browser extension or mobile app. It is specifically designed for the Cosmos ecosystem and is enabled by Inter-Blockchain Communication (IBC).

Step by step procedure

1. Bridge Tokens: First, make sure your DYDX tokens are on the dYdX chain by following how to route from Ethereum to dYdX Chain.

2. Set up Keplr Wallet:

New users: Install the Keplr wallet extension, create an account and go to the staking dashboard. Existing users: Import your wallet using a passphrase and go to the staking dashboard.

Pinching

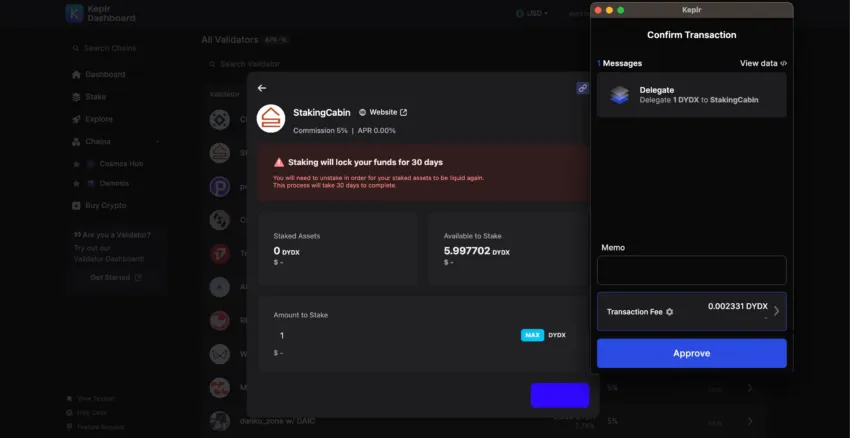

Access the ‘Staking' section on the Keplr dashboard. Select an authenticator from the list and determine the amount of DYDX to be paid. Confirm the transaction by paying the required gas fee.

Follow this how-to guide for more information.

Liquid deposit option

You can also choose to liquidate through platforms like Stride, Quicksilver, and pStake Finance, which allow you to share DYDX and receive liquid stake tokens in return.

DYDX staking is a straightforward process: once your tokens are paired and your Kepler wallet is ready, you're ready to jump. By winning, stakers will not only secure the network, but 100% of the protocol fees will be paid to the DADX chain. Choose your insurer wisely to maximize your returns and protect your investment.

Taking it out again

Redoing DYDX Tokens allows you to transfer your stored tokens from one validator to another without spending any connection time on the DYDX chain. This guide will walk you through the re-delegation process using the Keplr wallet, which will keep your tokens active and continue to earn rewards as you switch validators.

1. Access the list of validators: Log into your Keplr wallet and go to the stacking section where your current validators are listed.

2. Start logging again.

Click the arrow next to the validator where your DYDX tokens are currently held. Select “Re-release” from the options.

3. Select New Authenticator:

Select the new authenticator you want to change your delegation to. Enter the amount of DYDX tokens you wish to redeem and confirm by clicking ‘Redeem'. Complete the transaction by paying the necessary gas fees on the dYdX chain

4. Confirmation

After the transaction, check your dashboard for an update on the allocation of shared tokens.

Re-representation is an important feature that enhances the ability to change strategies without increasing reward potential. It is important to consider the performance and reliability of new validators. Remember, the risk of your tokens dropping will follow the performance of the original validator until the U-connection expires.

Unloading

Unloading DYDX tokens is the process of removing your tokens from being actively held with proof on the DYDX chain. This guide provides an overview of the steps to withdraw your shares using the Kepler wallet, details the binding period and the post-event handling of the tokens.

Step by step procedure

Access your Keplr dashboard: Open your Keplr wallet and navigate to the validators that hold your DYDX tokens. Start uninstallation: Click on the verifier you want to uninstall. Enter the number of DYDX tokens you wish to withdraw and confirm by clicking ‘Udelegate'. Pay the required gas fee on dYdX Chain to process the transaction. Attachment time:

Note that your DYDX tokens will enter a 30-day binding period, during which they are inactive but at risk of being deducted from the original validator.

DYDX tokens allow you to regain control of your assets, but it requires understanding the risks and timing due to the peg period. Once locked, you can choose to recapture with a different validator or manage your tokens as you wish. This flexibility supports a variety of strategies tailored to your investment goals and risk tolerance.

Key Issues in Staking

Confirmatory performance

The choice of verifier is critical as verification performance and reliability will affect stock awards. Validators with higher uptime and efficiency in the transaction process can generate higher rewards for their stakeholders.

Risks of extinction

Hacking on blockchain networks involves certain risks, including hacking. If a validator acts maliciously or fails to perform their duties, they and their stakeholders may be penalized by truncation (partial loss) of their held tokens. Therefore, it is important to choose a reputable and reliable authenticator.

Lockout times

Stored DYDX tokens are locked in during the holding period, which means they are not liquid and cannot be traded or transferred. Understanding the terms associated with lock-in periods, including any conditions that may affect the ability to remove or move held tokens, is essential to planning an effective staging strategy.

Advanced stacking strategies

Experienced stakeholders can engage in strategies such as staking derivatives, where they represent tokens held using synthetic assets, allowing them to remain liquid. Additionally, variable stake strategies may involve changing stakes among validators based on performance and reward predictions.

Conclusion

DYDX tokens secure and stabilize the network, distribute 100% of protocol fees to stakeholders in USDC, and allow the community to participate in managing a fully decentralized market-leading protocol. So far, over 15% (153M) of the DYDX token supply has been locked up and protects the DYDX chain. Realtors should manage risk when choosing DYOR and understand the risks if they decide to engage in advanced staging strategies.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.