Impact of BOJ Rate Hike: Is the 1929 Stock Market Crash Due to Bitcoin?

The Bank of Japan (BOJ) hit a historic 25 basis point (bp) high, raising its benchmark lending rate to 0.5%, the highest since 2008.

Although widely expected, this move has traders and investors on the edge of their seats in anticipation of its impact on Bitcoin and the crypto markets in general.

BOJ rate hike and global financial impact

The BOJ's decision in By early 2024, it would see a third rate increase. This marks a change in Japan's monetary policy amid high inflation, which is expected to remain between 2.6% and 2.8% in 2025.

Accordingly, Japan's economic growth forecasts have been revised downwards, adding complexity to an already volatile financial environment. A strong Japanese currency could disrupt yen carry trades due to a relative increase.

In a commodity trading strategy, investors invest yen in high-yielding assets at low interest rates. This unwinding could create a chain reaction in global liquidity, affecting risk assets including cryptocurrencies, stocks and commodities.

Bitcoin fell 3 percent following the announcement but is already trying to recover. Ethereum, Solana, Dogecoin and Cardano also experienced corrections. The shift in thinking is likely related to President Donald Trump's executive order for digital asset reserves in the US.

The immediate correction suggests Bitcoin's sensitivity to macroeconomic changes, with investors reducing their exposure to higher risk exposures. However, some analysts predict further downside for Bitcoin after the trend in the US fades.

“Bitcoin could reach a massive 50% discount,” crypto analyst Financelance predicts.

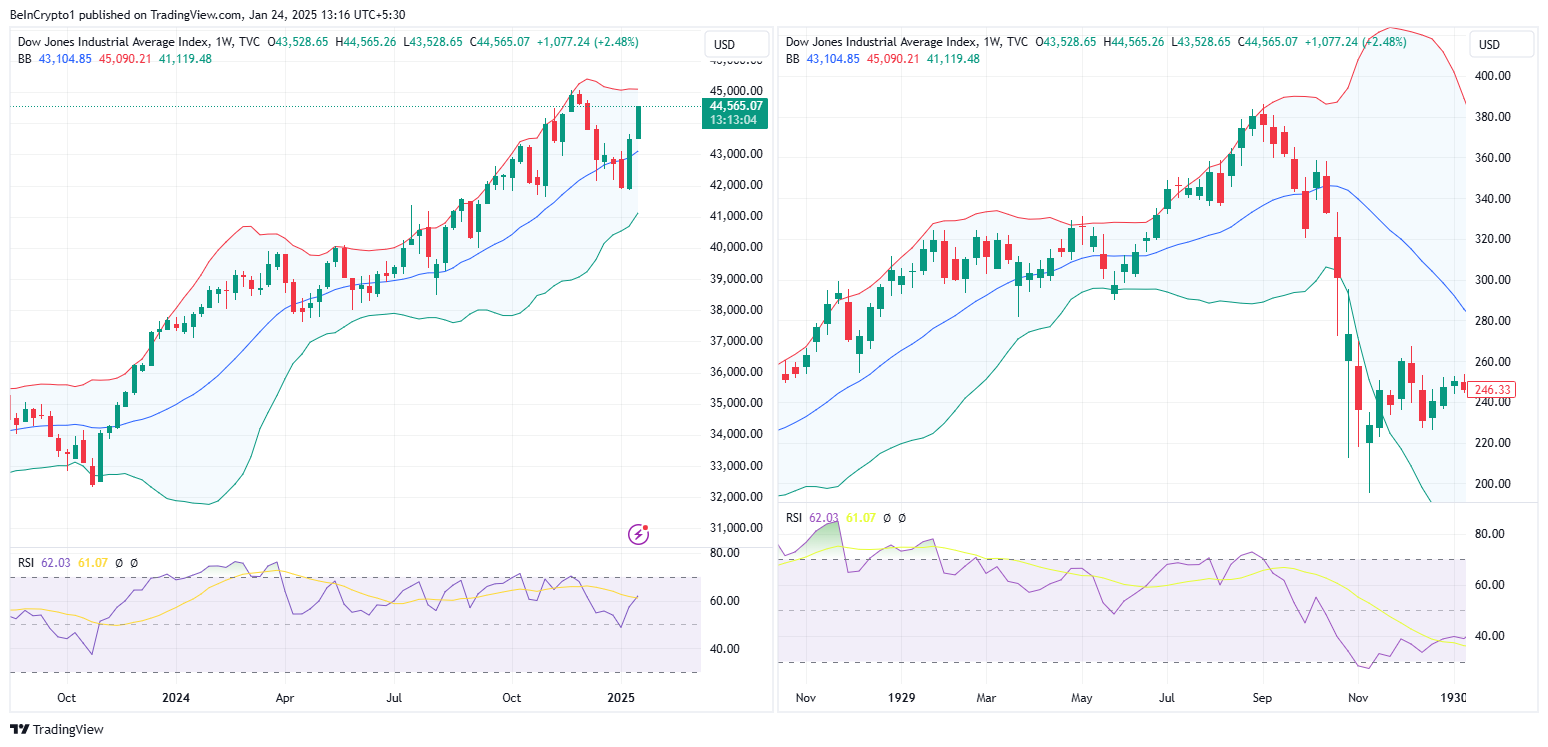

The analyst Similar to the stock market crash of 1929, it highlights the dangers of speculative bubbles. They pointed out a striking similarity in technical indicators such as the Relative Strength Index (RSI), which currently shows those dating back to 1929. The analyst predicts a flash crash around the end of January 2025.

According to Financial Lott, events such as VIX options expirations and geopolitical tensions can accentuate volatility. On the other hand, some voices in the crypto space like @0xKiryoko remain cautiously optimistic.

“…international markets are going to feel it. Crypto included. Solana's ETFs and pro-crypto president won't matter in the short term if liquidity dries up…but the bullrun isn't over. NFA, such opportunities are not pure and simple,” she said.

Meanwhile, the BOJ's rate hike isn't the only factor weighing on the crypto market. Global instability, including US trade policies and geopolitical developments, is increasing in complexity. Another market analyst, Cypress Demanincore, pointed out that the Trump administration's economic strategies are creating more volatility.

While the biggest force to consider is the BOJ's interest rate hike, everyone's attention was on Trump's inauguration for the next major market move.

Traders and investors should monitor the implications of the BOJ's rate hike implementation. Historically, such moves have resulted in periods of short selling, where there is a reversal of trade.

“In the year The same thing happened on July 31, 2024. Short-term sales pressure and discount prices that last for a few days depending on the release. In the past there was a week's worth of selling pressure,” added Demanincore.

The current environment reflects the need for caution and strategic planning for cryptocurrency investors. While the market may experience inevitable volatility, this can create opportunities to pick up assets at discounted prices.

“I feel sorry for everyone who exited the market over the last couple of days due to the BOJ concerns and the lack of strategic bitcoin reserve news. If you want to be a successful investor, you need to have a longer time frame in mind. Patience pays off. Remember, 10 days in a bitcoin cycle will give you the most profit. Good luck with that time frame.” ” said one crypto investor.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.