Impact of MiCA regulations

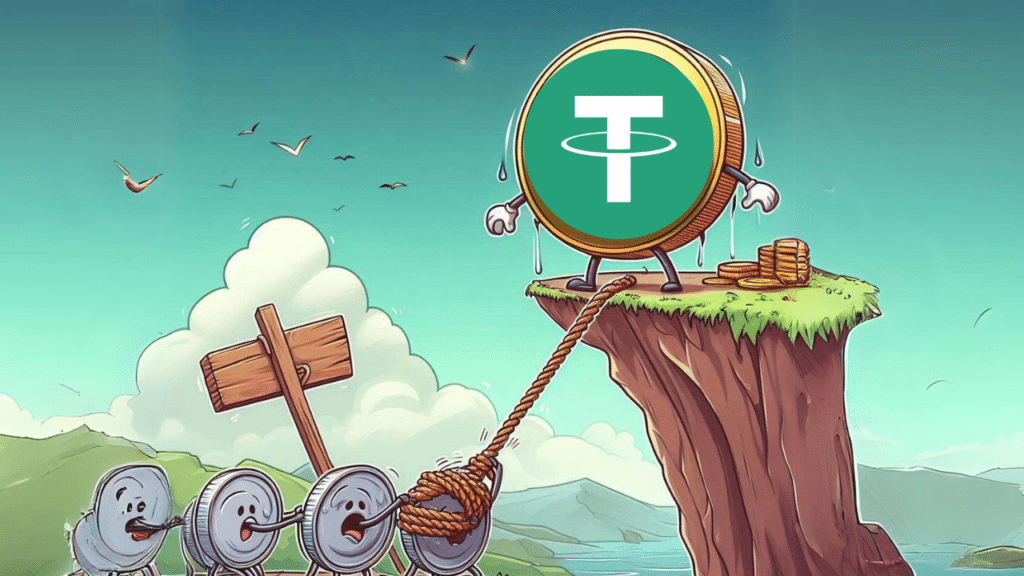

Tether (USDT), one of the most popular stablecoins in the crypto world, is facing a major risk. European MCA (Markets in Crypto Assets) regulations are making things difficult. These new rules could seriously affect Tether's operations in Europe. Paolo Arduino, CEO of Tether and CTO of Bitfinex, stated that the MCA is putting strict limits on the size and supply of fixed coins. It also requires 60% of Statcoin reserves to be held in cash deposits in banks. The problem? These deposits are uninsured over €100,000. This could lead to massive bank runs, causing instability for both stablecoins and traditional banks.

A sign of national economic decline

Arduino shared his thoughts in an interview with Cointelegraph. He said the success of the USDT reflects the failure of many national economies. Tether gives people an alternative when their economy is struggling. Take Japan for example. The stock market there is down, and the yen is unstable. Governments and central banks are printing too much money. This led to economic instability. That's why many people are turning to crypto and stablecoins like USDT.

Tether's strategy and compliance efforts

Despite the rough roads, Tether will not back down. The company is actively negotiating with European regulators to improve these new regulations. Arduino points out that Tether is not alone in facing these challenges. Even their main competitors are concerned about the same issues. Arduino hopes that through these discussions, they can develop a secure and functional control framework. Meanwhile, they plan to increase their Tether team to 200 employees by the middle of next year. The main focus will be on strengthening the subordinate group. This move shows how serious they are to address any issues regarding illegal activities involving SunStocoin.

Achievements and future prospects

Despite all these challenges, Tether is making impressive progress. USDT recently hit a historic milestone by surpassing $115 billion in distributions. Last week, the market cap topped $1 billion. This happened at the same time that the price of Bitcoin rose to $62,000. According to Lookonchain, $1.3 billion USDT has been transferred to major exchanges including Kraken, OKX, and Coinbase. This increase has helped USDT solidify its position as a major player in the stablecoin market, which now holds a 70% market share.

According to Tether's transparency page, more than 50% of its supply is Tron. About 41% is on Ethereum. Tether reported a record $5.2 billion in revenue for the first half of 2024. That's impressive, especially considering Tether has a smaller workforce than other tech and crypto giants.

Tether is promoting blockchain education. He has partnered with the African Blockchain Institute. This collaboration aims to educate students in five universities in Ivory Coast about blockchain technology. This also includes education related to cryptocurrencies, smart contracts, DeFi and industrial applications.

Conclusion: Facing challenges and celebrating victories

The new MiCA regulations are throwing some big challenges at Tether and the statcoin market. The tighter rules about reserve requirements could raise risks and USDT futures in Europe are a bit shaky. But even with these setbacks, Tether has proven strong and determined to push forward. The company's achievements speak volumes for its strength and innovative drive. As the crypto world deals with these changes, it is important for companies and regulators to continue to communicate. Watching how Tether handles these regulatory issues will be key for anyone invested in the crypto scene.

Also Read: Gemini And Coinbase Clash With CFTC Over 2024 Presidential Betting Ban!