It starts at 30% and $4 billion is announced

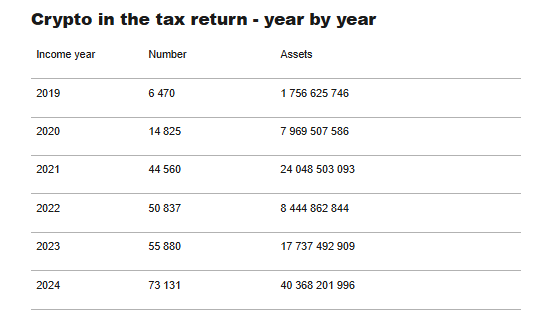

Norway in 2024 tax returns that reveal digital assets, more than 73,000 people in the new areas of the Norwegian Tax Administration (STATETETATER) reported a spike in 724 years.

The operation represents a year-on-year increase as records begin and transparency grows in the country's digital asset market.

The total value of more than 40.3 billion ($ $ $ ($ $ ($ $ ($ $ $ $)) has been reported so far).

Sevenfold growth – in Cippo statements – What's behind Norway's tax loophole?

Nuna Santas, Director of Taxation, said the increase reflects the success of recent measures to encourage voluntary participation.

“Many people appreciate the fact that it is refreshing, and in this way, in this way, it is to confirm that the tax is correct,” she said. We have taken several measures in recent years to increase this number, and we can see that these measures are having an impact. “

In the year In 2019 In the year In the year In 2019, less than 10,000 Norwegians reported owning SINEPTO assets. That number has now grown more than seven times.

After the increase, after the tax, it started sending digital notices known as Decatas, which can be called secret or virtual property, but could not declare them.

The final amount of data is reflected in the 2024, which will significantly increase the value of the entire digital environment. As Statatteetedred Crueptovess Alds reached 5.5 billion dollars, reports for some time are about 2.9 billion nok.

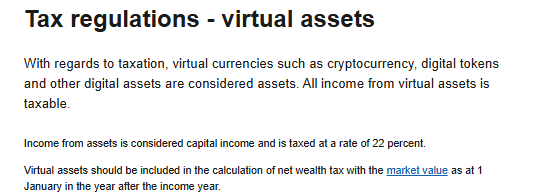

According to Norwegian law, cryptocurrency is not a transaction, it is not a currency, which means that profits and losses are subject to capital gains.

The current tax rate is a flat 22%, and the same rate applies to certain losses.

They arise when a digital asset is sold, sold, exchanged, or exchanged for goods or services.

For example, an investor bought for 20,000 Norwegian kroner and sold 1 with 50,000 kroner, the 30,000-kroner profit is taxed at 22%.

Armo for the wealth tax: – How Norway moves and expands obligations as they contemplated

The first coins bought by the Norwegian system are the first coins to calculate the first sports.

In addition to the capital income, DGPS holders must declare their net worth as an amount of wealth every year. Wealth over 1.7 million is subject to Norwegian wealth tax, which varies according to income and municipality.

Income from mining, driving, or air pollution must be reported as normal income, which is chosen at the stage of the process based on the amount of income of the taxpayer.

Norway's crypto tax system is based on self-reporting, meaning individuals are responsible for reporting their own crypto activity through their “own” online portal.

Taxpayers must calculate the Norwegian kroner in Norwegian kroner using the exchange rate on the day of the transaction. Failure to declare these assets may result in additional tax penalties or audits.

Aslenmark revealed that many first-timers were reporting small sums, while authorities revealed unexpected amounts through DKs.

Those who voluntarily correct their statements can make corrections for up to three years to avoid penalties, provided the correction occurs before the official audit begins.

How far is Norway in Norway?

From 2026, Norway's control will be further expanded under new third-party reporting rules.

Linens and acid suppliers operating in the country will be completed to report user data, giving the tax authority more accurate insight into the incentives of residents.

“This is a more accurate tax of digital assets,” said the director of tax, Nina Santa Fes, which is important. With this development, we have an even better overview of the property that is expanding both in Norway and abroad.

Taxes collected from cryptocurrency development in Norway flow into the country's general government revenue, helping to create public infrastructure, education, healthcare and social services.

Crypto-related tax income is not treated differently from stocks or other capital investments.

Norway's digital asset connects to a wide cross-section of ratings in the digital asset sector.

In the year By 2025, the government has moved to introduce national legislation introducing strong consumer protection laws for service providers and consumer protection in the European Union Markets (MIC) Regulation.

A temporary suspension of new energy reform projects was also announced in June, citing environmental needs and energy conservation priorities.

In the meantime, the government's ethics policy is led by Hygig Global, which will be implemented in 2024. In the 2024 budget, it is being prepared to investigate the risks of accidents and gambling companies.

The Council's findings reflect Norway's cautious but cautious approach to the secret, which can lead to jokes from some companies.

Closing news news analysed, cryptographic predictions

![[Live] Crypto News Today: Latest Updates For Nov. 25, 2025 – Bitcoin Holds Above $87K In Broad Market Rebound; Glassnode Flags Oversold Conditions With Early Signs Of Recovery](https://coinsnewsdesk.com/wp-content/uploads/2025/11/Latest-updates-for-N-Novel-25-2025-300x200.jpg)