Justin Sun, Andre Cronje Binance Charges Zero Listing Fees, Coinbase Asks Millions

Key receivers

Justin Sun and Andre Cronje say Binance doesn't charge any listing fees, while Coinbase charges up to $300 million. According to the CEO of Moonrock Capital, Binance will require a portion of the total project token supply as a fee for listing.

Share this article

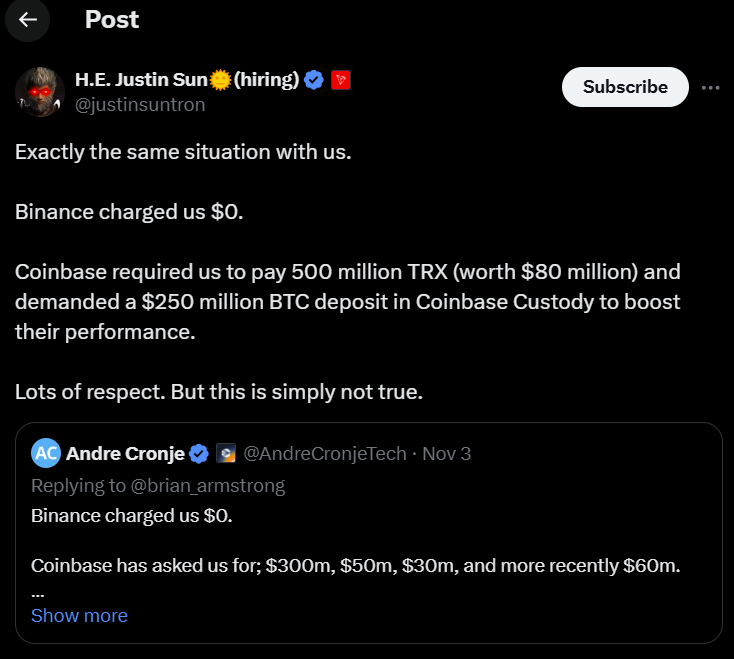

Tron co-founder Justin Sun and Phantom Network co-founder Andre Cronje have confirmed that Binance does not charge fees to list their tokens. In contrast, Coinbase has charged millions of dollars for the same services, contradicting Coinbase CEO Brian Armstrong's public statement that the listings are free.

The controversy surrounding listing fees on Coinbase and Binance comes from a post by Moonrock Capital CEO Simon Dedick. Dedik expressed frustration with the practices of crypto exchanges, particularly Binance.

According to him, projects seeking to list on Binance had to go through “years of due diligence.” After passing this stage, you are required to list a significant portion of the project's total token supply.

“Not only is this inappropriate for projects, but these symptoms are the biggest reason for bleeding charts,” he said.

In response to Dedik's post, Armstrong said that “asset listings on Coinbase are free,” inviting projects to apply through their asset listings.

However, Cronje commented on Armstrong's post that his experience was different. Coinbase approached Project Phantom with a request to list payments ranging from $30 million to $300 million, recently valued at $60 million.

Sun backed up Cronje's assertions, stating that Coinbase requested 500 million TRX (approximately $80 million) to list TRON on its platform. Coinbase also mentioned that $250 million in bitcoin deposits would be required to be placed under escrow in order to upgrade the funds.

Not all projects can easily secure a listing by paying a fee, says Binance's He Yi

According to He Yi, co-founder of Binance, if a project does not pass the exchange's strict evaluation process, it will not be listed, regardless of the financial offer or the percentage of tokens.

Yi explained that Binance evaluates projects based on their overall quality and potential, not just their willingness to pay. She also mentioned that while Binance has clear rules regarding airdrops and partnerships, simply offering tokens or airdrops does not guarantee a listing.

Responding to the claims, Dedich expressed her doubts that she did not overcharge for the listings.

“So those are pure lies and Binance isn't asking a project for 15% or more tokens? It doesn't matter what you call it as long as you're getting those payments from the hardworking founders at the end of the day,” he said.

Share this article