Key resistance levels and TVL growth potential

The price of SUI is in a strong upward trend, drawing the attention of the crypto community as it approaches significant resistance levels. Growing to over $957 million in total value locked (TVL), the network's fundamentals have strengthened, boosting investor confidence.

This rapid growth is positioning SUI as a key player among the “Ethereum killer” candidates, ahead of competitors such as Sey, Mantle and Aptos. As the SUI nears its all-time high, bearish technical indicators suggest further gains are possible if it manages to overcome upcoming resistance points.

The SUI TVL Crowdfunding: The Road to $1 Billion and Beyond

Total Value Locked (TVL) in the SUI ecosystem has grown to $957 million as of September 24, 2024, a significant increase from $338 million as of August 3. TVL represents the amount of capital invested in decentralized finance (DeFi) protocols in a specific network. It includes assets involved in activities such as stocks, loans and financing.

A growing TVL is often seen as a bullish indicator because it reflects increasing trust and participation in the network's protocols, increasing the utility and demand for the native token. As more assets are locked into the SUI ecosystem, it suggests that users are willing to commit their capital, reducing the token's circulation and potentially leading to upward price pressure.

Read more: Everything you need to know about Sui Blockchain

Additionally, when TVL approaches major milestones, such as TVL's $1 billion mark for SUI recently, it attracts attention from many investors. Getting to this point shows strong growth and fluidity in the ecosystem. This can lead to greater market confidence, a positive feedback of price growth, and more capital inflows.

As TVL grows, the overall health of the ecosystem improves, increasing the liquidity of decentralized applications, increasing transaction volumes, and leading to continued value growth for SUI. With more mergers, like Circle USDC's launch on SUI, its TVL is likely to continue growing in the coming months.

SUI is better than other “Ethereum killers”.

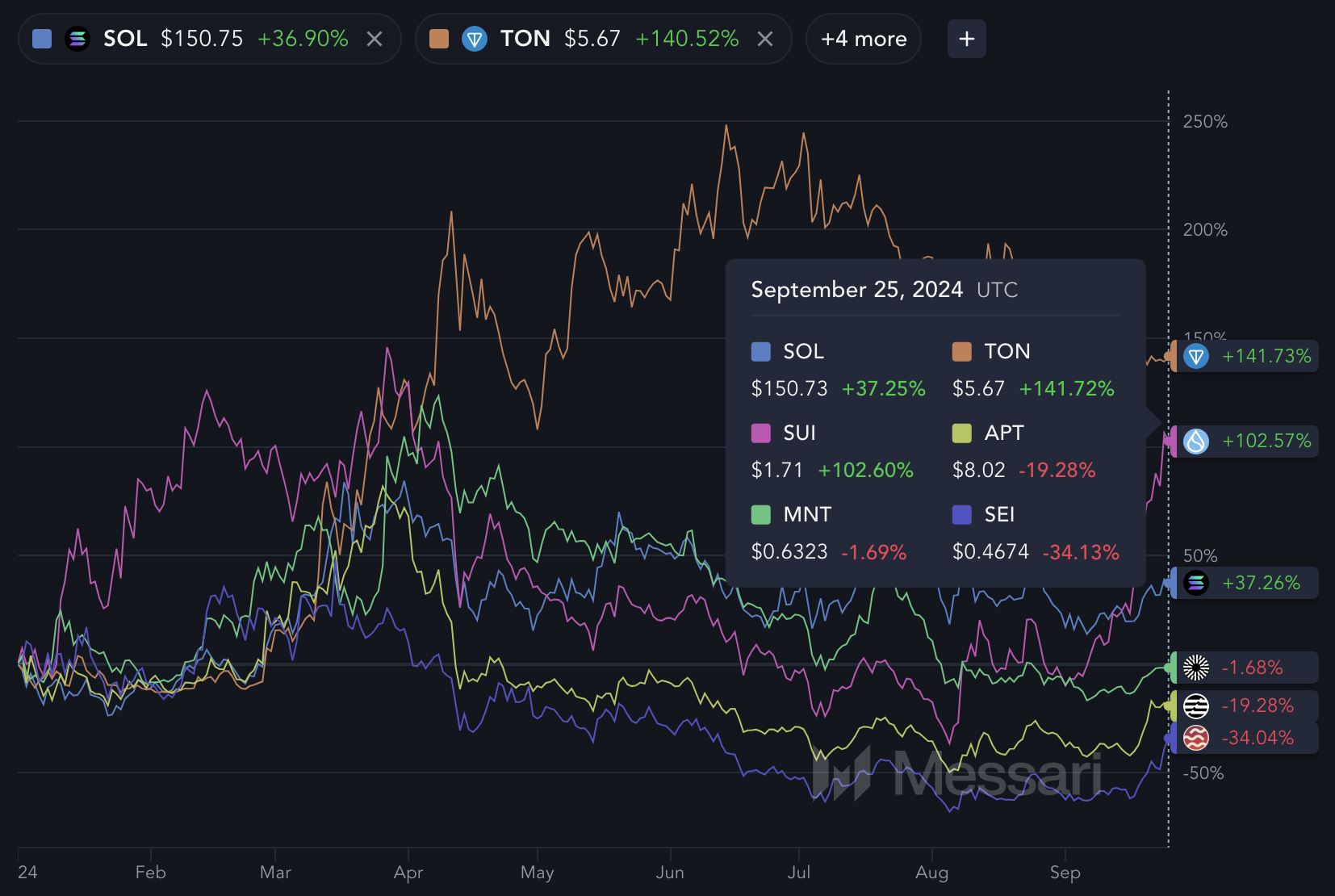

When looking at the performance of the “Ethereum killer” candidates, Solana remains the clear leader. It is currently priced at $150.75 and is up 37.25% year-to-date. Its dominance is well-established, with a massive market cap of nearly $70 billion.

However, Ton is getting a lot of attention, boasting a 140.52% increase and a market value of $14 billion. Despite these two giants, it seems that there is room for another major player in the space.

Among its competitors, Sui stands out, especially when compared to other up-and-coming chains such as Sei, Mantle and Aptos. Sei and Mantle show negative returns (-34.13% and -1.69%). Aptos showed a significant decrease (-19.28%).

On the other hand, Sui has more than doubled in value, up 102.60% YTD.

Crypto can easily handle another “Ethereum killer” with a market cap of more than $10 billion. With Solana far from that level and a ton at $14 billion, Sui's momentum suggests it could be the next chain to break this significant threshold.

Its strong growth metrics and improving adoption rate put it in a prime position to compete at the same level as Solana and Ton, which could be a key player in the future of multi-chain in decentralized applications.

SUI price forecast: $2.20 in October?

SUI is currently trading around $1.70, still 28% off its all-time high of $2.18. The price has recently been in a strong uptrend, with several EMA lines converging in a bullish configuration. Exponential moving averages are trend-following indicators that give more weight to recent price action.

On this chart, the EMAs are clearly correlated in a bullish pattern, with the short-term EMAs above the long-term EMAs. This type of alignment indicates strong upward momentum in the market.

Read more: Top 10 Sui (SUI) Wallet Guide in 2024

If SUI continues its current trend and breaks above key resistance levels at $1.95 and $2.07, the price may be poised to challenge the previous all-time high of $2.18 and move further targeting $2.20 or higher.

However, failure to breach these protective standards may result in retroactive action. If so, the nearest support level is around $1.41 where the price could stabilize before attempting another move higher.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.