Layer 2 arbitrage (ARB) sees the demand level to new lows

RB, the native token of leading Layer 2 (L2) network Arbitrum, has dropped significantly over the past few weeks. On July 5, the altcoin traded at a low price of $0.57.

Although ARB prices grew by 22 percent, declining consumer demand for the L2 network threatens to wipe out these gains.

Judgment of the user's exodus of witnesses

On-chain data shows that since June 21, user demand for arbitrage has decreased. Since that date, the daily count of active addresses that have engaged in at least one transaction on L2 has fallen by more than 46 percent.

As the number of unique addresses active on the network has dropped, the number of transactions completed daily on Arbitrum has decreased.

After reaching a year-to-date peak of 3.5 million, L2's daily transactions have started a downward trend. It has declined by 34 percent since then.

Read more: How to buy Arbitram (ARB) and everything you need to know

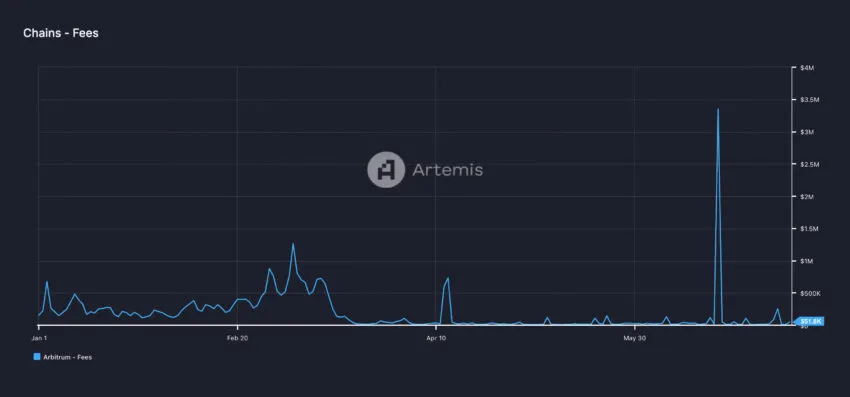

With fewer completed transactions on L2, Arbitrum Network fees and revenue from them are at multi-month lows. Arbitrum's total network fees rose to an all-time high of $3.4 million on June 20 as L2 was used as the primary coordination chain for LayerZero's airdrop.

However, after the controversial weather ended, users flocked to Arbitrum the next day, slashing the network's fees by 98 percent.

The network's revenue dropped 99 percent in 24 hours.

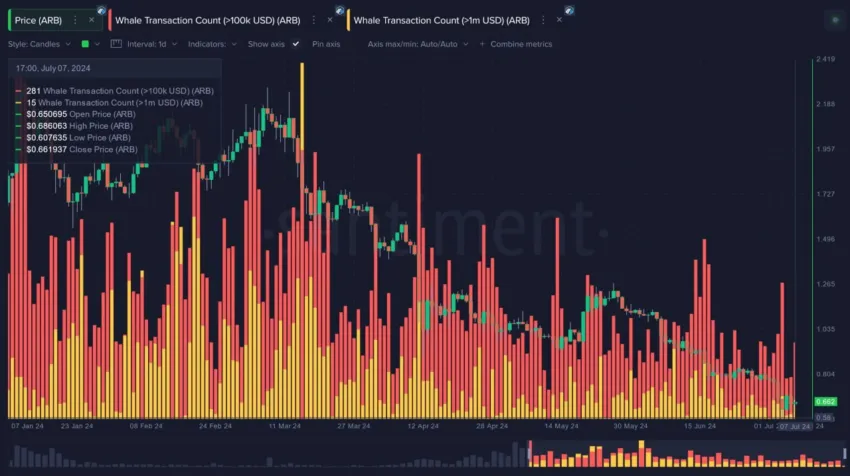

Brian Quinlivan, lead analyst at Sentiment, added to the bearish sentiment, noting that the whales could hold out for higher momentum before switching funds:

“The lack of whale activity is similar to what we've seen for optimism. The gradual decline of large movements is not a bad thing. This means that they may be waiting for a little more flexibility to use properly before making their move. Quinlivan said.

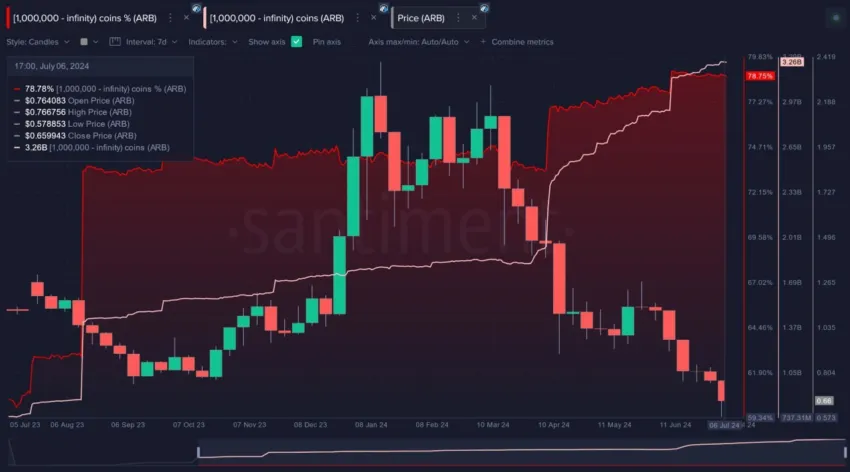

Quinlivan added that even with a major price cut in 2024, wallets containing at least one million ARBs will hold a very high supply of arbitrage.

These key stakeholders feel comfortable holding on to their coins for the long term despite the market price dropping by over 70% in 6 months. Quinlivan added.

ARB Price Forecast: Ready for a Re-Tang?

While the price of ARB showed a downward trend last week, Chaikin's cash flow (CMF) is at a high level. This indicator measures how money flows into and out of the property.

As his CMF rises and the value of the property falls, a significant difference is created. This difference indicates the possibility of a price reversal. It suggests that the selling pressure may be weakening, and the property may be ready to return to value.

If this happens, the price of ARB could increase to $0.72.

Read More: Arbitrum (ARB) Price Forecast 2024/2025/2035

However, if the current decline continues, the price of the token will drop to $0.66.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.