Multi-million dollar companies have revealed their 2024 Bitcoin price forecast

Despite the recent turmoil in the crypto market, leading financial institutions remain bullish on the future of Bitcoin as stated in their assessments.

In the year As 2024 begins, these organizations predict a major boom for Bitcoin, with price predictions ranging from a moderate increase to $80,000 to a dramatic increase above $600,000.

Messari: Bitcoin can be equal to gold

Mesari, a well-known name in crypto analytics, predicted that the price of Bitcoin will exceed $600,000. His analysis highlighted Bitcoin's resilience and dominance in the cryptocurrency market, citing its ability to lead recoveries and outpace other digital currencies.

“We've recently seen multi-year highs for bitcoin dominance, but still nothing close to the high-water mark we reached at the start of the 2017 and 2021 bull runs. Bitcoin dominance dropped from 87% to 37% in 2017. It returned 70% during the consolidation and reached $40,000 in 2021, dropping to 38% at the height of the bubble. We only touched 54%. There is still room for consolidation,” Mesari analysts argued.

Acknowledging potential challenges such as regulatory issues in the DeFi sector and a slowdown in NFT activity, Mesari's view was based on Bitcoin's historical performance and its value relative to other assets.

“We probably won't see another 100x for Bitcoin, but the asset could easily outpace other established asset classes by 2024. Eventually parity with gold will result in a price of more than $600,000 per BTC,” analysts at Messari concluded.

VanEck: Bitcoin Income to Mimic Gold Post-ETF

Van Eyck, a global investment manager, has set his sights on a price of $275,000 for Bitcoin. The reason is based on the growing demand for “hard money” assets like Bitcoin and gold, especially during economic downturns.

“As debt levels tend to be more sovereign than corporate or household, we expect more than $2.4 billion to flow into newly approved U.S. spot Bitcoin ETFs in Q1 2024 to keep Bitcoin prices higher. While significant volatility is likely, Bitcoin prices in Q1 2024 will rise from $30,000 to $30,000.” VanEck analysts emphasized that the dollar is unlikely to go lower.

Read more: How to prepare for a Bitcoin ETF: A step-by-step approach

VanEyck drew parallels between the initial success of gold ETFs and the ability of Bitcoin ETFs to attract significant capital inflows, bolstering the cryptocurrency's value. The company anticipates a significant increase in Bitcoin's market share from gold, driven by heightened awareness of monetary policies and potential regulatory shifts due to the US presidential election.

“The GLD ETF was launched on November 18, 2004, and saw approximately $1 billion in inflows in the first few days of its launch, and at the end of Q1 2005, approximately $2.26 billion was in GLD… We used these figures in the spot market for Bitcoin, the first in the BTC spot ETF. We reached $310 million in a few days and ~$750 million in the quarter, VanEck analysts explained.

ETC Group Balanced View: A little over $100,000

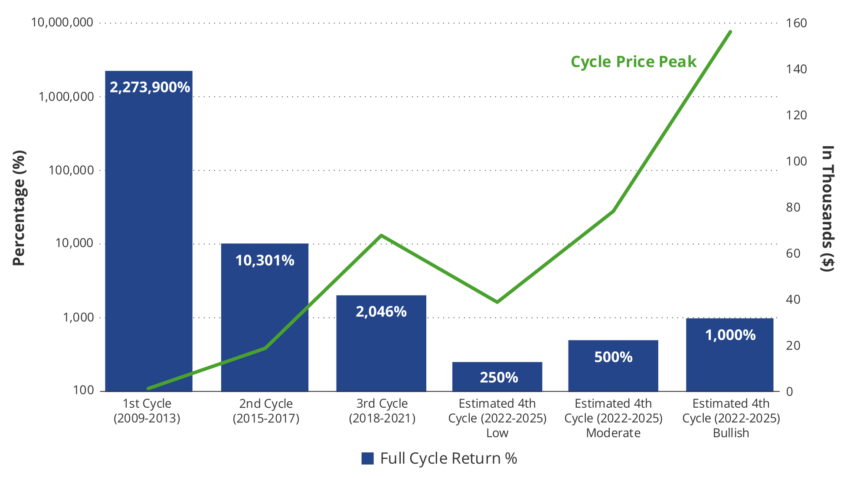

ETC Group, another player in the financial system, has predicted that Bitcoin will slightly exceed $100,000. His prediction is based on the expected increase in Bitcoin adoption triggered by the upcoming Bitcoin Halving in April 2024.

“Some researchers argue that from a purely theoretical point of view, the Bitcoin Halving should already be valued because it is public knowledge, we show in practice that these events have been followed by high price appreciation in the past. In particular, the price of Bitcoin will reach a new all-time high in 2024 and 100,000 by the end of 2024. We expect the dollar to break, ETC Group analysts confirmed.

Read more: Bitcoin half-cycles and investment strategies: What you need to know

The company's forecast takes into account various chain metrics, such as a declining supply of bitcoin exchanges and an increase in long-term holdings, which suggest a tightening market that could push prices higher.

“Currency supply % is at 5-year low, Supply % active 1+years is at all-time high, Illegal supply scale at Glassnode is at all-time high, 3-month + guaranteed cap HODL wave is high. Over the last cycle. These metrics on the chain indicate that both liquidity exchanges are relatively thin and that there is plenty of ‘dry-powder' in terms of supply distribution during the next bull cycle, ETC Group analysts concluded.

Bitwise Estimate: Over $80,000

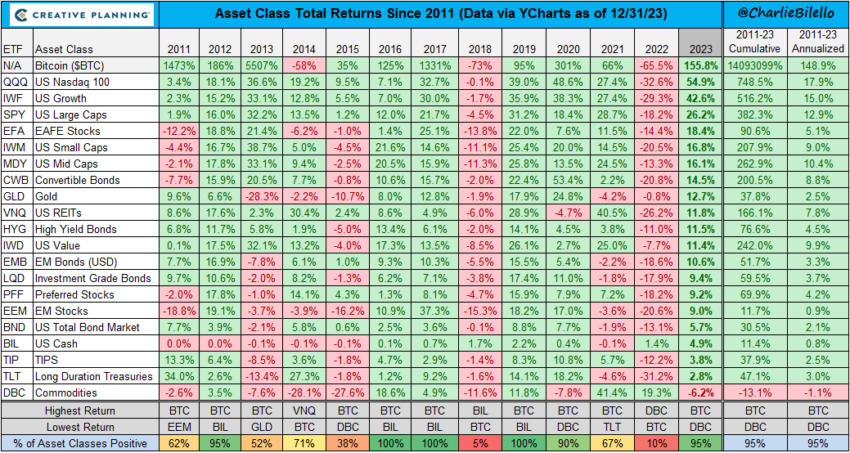

Bitwise, a well-known asset management company, thought Bitcoin would exceed $80,000. The confidence stems from Bitcoin's stellar performance in 2023, outperforming major asset classes.

“Bitcoin in 2018. In 2023, it outperformed all major asset classes, rising 128%, the S&P 500 returning 21%, gold returning 12%, and bonds returning 2%. We expect this trend to continue in 2024, with Bitcoin trading above $80,000 and setting a new all-time high,” Bitwise analysts wrote.

The company highlighted two main reasons for this growth. One is to launch a spot Bitcoin ETF. And the second is Bitcoin Halving, which is expected to limit the supply of new BTC as demand increases.

“The launch of the Bitcoin ETF (expected in early 2024) is expected to bring a new wave of capital from retail and institutional investors, fueling demand for Bitcoin. Meanwhile, the supply of new Bitcoin produced each year will be halved following the next Bitcoin halving in April or May 2024,” they said. Bitwise analysts said.

These institutional Bitcoin price predictions clearly show the potential direction in 2024. Despite the different details, they collectively show their optimism about Bitcoin's future. This bullish view is based on factors such as Bitcoin's historical dominance, the expected increase in adoption following the Bitcoin halving, and the expected capital inflows from the new space Bitcoin ETFs.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.