Prices rally to 21-month highs: Can bulls wait longer?

After the price increase on the daily chart, yesterday it left a serious volcano. The effect was felt by the bears who were waiting for the decrease.

Anything ahead of NEAR will hurt the bears more, but if the altcoin follows the path set by history, it could be vindicated.

The near-explosion of the price is gone

After a 38% rally in the last 24 hours, the price can be seen trading at $5.64 at the time of writing. While fruitful for many, the surge followed three red candles from the previous days, proving to be an unsettling event for bears betting on the altcoin.

Over $2.23 million worth of short contracts were canceled in one day. This marked the first incident on this scale in three months. However, what lies ahead for the native token of the DeFi protocol could upset the bears as all indicators point to a rise.

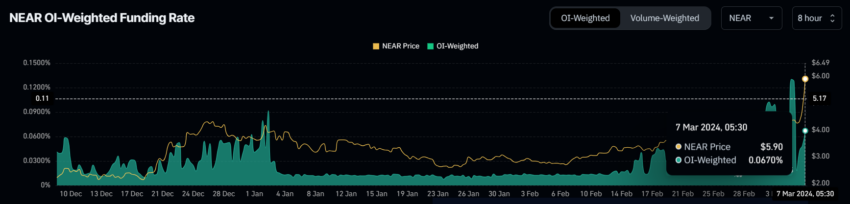

The open interest-weighted funding ratio is currently very positive at an average of 0.0670% for NEAR. Forward rates are periodic fees paid between traders who hold perpetual swap positions to maintain price alignment with the underlying asset.

Read more: NEAR price forecast for 2024

If the derivative price is different from the spot price, the long or short position holders pay or receive cash to maintain the balance. As such, positive rates indicate bearish sentiment in the market, and traders are signaling for further increases.

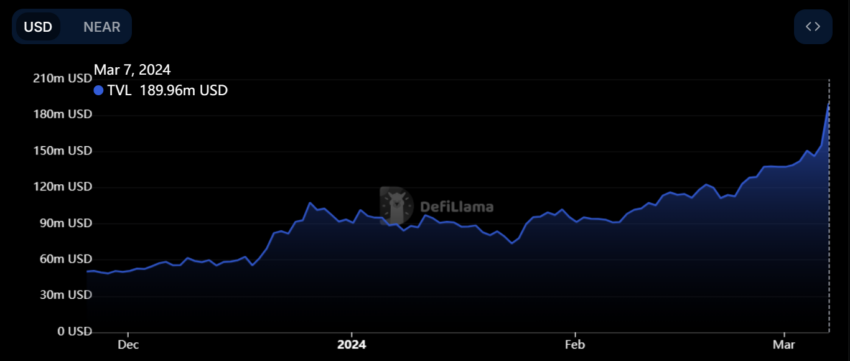

But beyond speculation, the use of the protocol is also seeing an increase. Amid the price surge on Wednesday, the Total Locked Value (TVL) on AR Protocol increased by 22.5% from $155 to $189 million in 24 hours.

This shows that the adoption of the protocol is growing along with the demand and makes the march significant.

Near Price Forecast: Fear of a correction may be coming.

Although the recent price increase, it did not consolidate the increase. This is because, currently, NEAR is facing the $5.60 barrier. It is unlikely to break it, but a reversal to support is essential for the price to continue its rise.

Once that happens, NEAR will be on track to mark the annual high of $6.50. Based on the above indicators, the bears can stay for a while to prevent further losses. This acts as a boost for the crypto asset and pushes it to a resistance level.

However, the Relative Strength Index (RSI) indicates that the asset is currently overbought. The RSI sits above 70 and appears to be declining. This is a sign of filling bullish sentiment, which could indicate an impending correction.

The RSI is a momentum indicator that traders use to determine whether the market is overbought or oversold.

A reading above 50 and an upward trend indicates that the bulls are still in advantage, while a reading below 50 indicates the opposite. The indicator is above 50 but is declining, which indicates that the bulls may lose steam after the recent price rally.

Read More: Top 7 Latest Wallets in 2024

Historically, this has been the case, and the same result keeps NEAR's price at the $5.60 mark. Losing this support level will invalidate the bullish thesis and send the cryptocurrency to the $4.85 level.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action taken by the reader on the information found on our website is at their own risk.