Sui emerged as the top destination for DeFi earnings in the past 30 days

Grand Cayman, Cayman Islands, February 15, 2024, Chainwire.

Wormhole data shows nearly $310 million in assets transferred from Ethereum to Sui Bridge in the past month — more than any other blockchain.

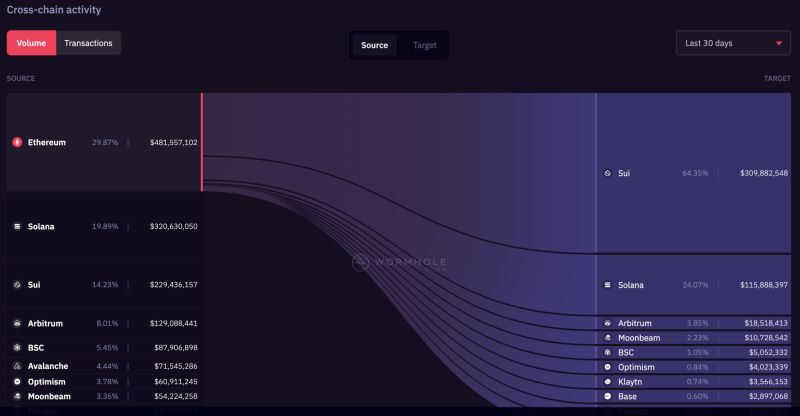

Sui, the Layer 1 blockchain that has seen explosive growth since its inception nine months ago, is seeing a massive influx of funds from Ethereum to the Sui ecosystem, with nearly $310 million worth of assets flowing through the wormhole portal in the past 30 days. The data was released by wormholescan.io, which monitors the flow of funds through Wormhole, one of the most important on-chain bridges for cryptocurrency tokens and NFTs, and the leading decentralized exchange Uniswap.

As the Sui ecosystem has gained incredible momentum over the past month – with a total value of more than $600M locked in and entering the top 10 DeFi ecosystems – data from Wormhole shows that Ethereum is the source of most of the funds. Of the nearly $500M transferred from Ethereum via Wormhole in the past 30 days, more than 64% went to Switzerland – more than all the funds sent to Solana, Arbitrum, Polygon and other chains combined. .

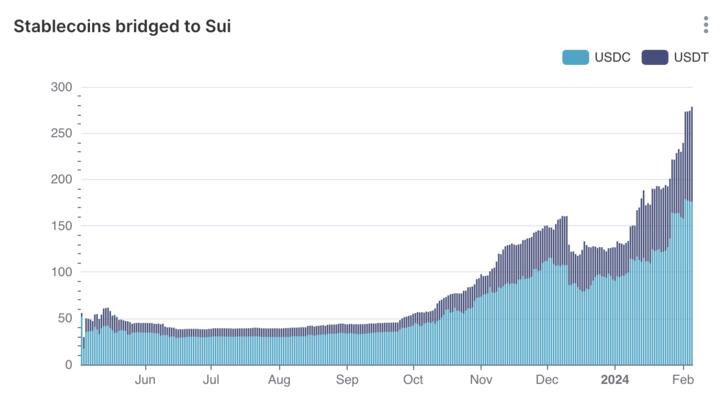

According to Wormhole data, most of these bridged assets are stablecoins, with USDC and USDT bridged to Sui at $134M and $78M respectively.

Source: wormholescan.io

Source: wormholescan.io

Sui Foundation Managing Director Greg Siouronis said, “The proliferation of users migrating their assets to Sui demonstrates growing confidence in the strength of Sui's supporting technology and the community of builders, developers and enthusiasts who manage the ecosystem.” “The Sui community looks forward to continuing to push the boundaries of DeFi and deliver an industry-defining experience for users and developers alike.”

Source: Sui Internal Data

In addition to Sui's emergence in Diffie, Sui's internal data indicates an acceleration in the development of the Sui ecosystem for the bridged stablecoin USDC and USDT launched in Q4 2023. Over $250M, an increase of over 400% in less than five months.

In recent months, in addition to empirical data, there has also been a qualitative trend that points to Sui becoming the epicenter of DeFi excitement and activity – major projects choosing to build on Sui. In December 2023, two leading projects launched on other protocols chose to expand or fully migrate SU.

Solnd, which has been the top lending protocol on Solana for nearly $180M at TVL, has committed an entire team to launch a new lending protocol on Sui called Suilend. Similarly, Bluefin, a decentralized derivatives exchange that generated more than $1B in trading volume on its v1 app on Arbittrum, shut down its initial application to focus on its new version built on Sui, which reached $2.3 billion in its first four months. on the network. Both projects cited Sui's performance capabilities in explaining their activities.

Recently, Suein announced two more important steps to transform the DeFi platform of choice for builders, developers, and users. First, along with Ondo Finance—the third largest platform for bringing tokenized real-world assets to public blockchains, Sui announced the launch of an interest-bearing stablecoin exchange on Sui. Just as important, a new partnership with Banxa, the leading payments infrastructure provider for the crypto-compatible economy, will launch on-ramps and remotely through the Banxa platform. Together, these steps broaden the appeal of Sui's platform to include a wider audience.

Connect

Sui Foundation[email protected]