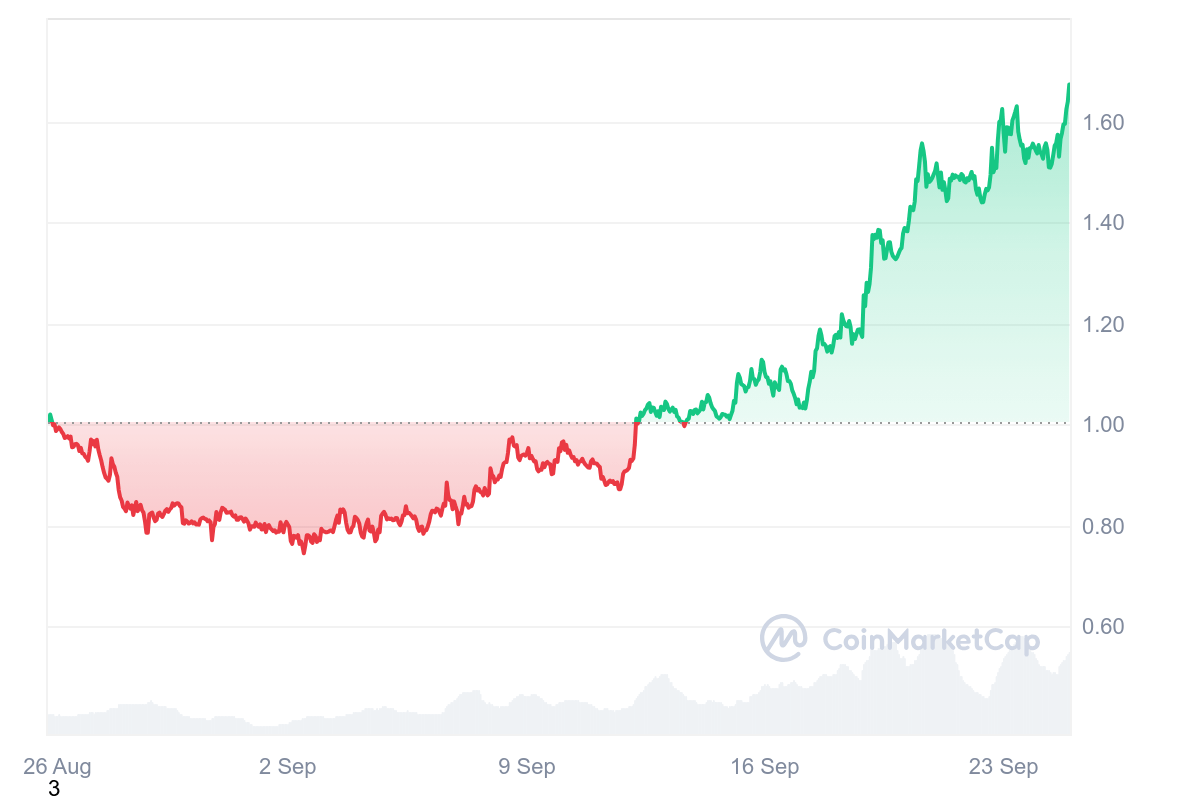

SUI value increased as TVL reached $1.3 billion.

Sui has seen a price increase of over 44% in the last week and 65% in 30 days. Profits will come after Greyscale Sui Trust opens to accredited investors. The total value of the locked Sui network exceeded $1.34 billion.

The price of SUI has risen over 44% in the past week to trade above $1.67. The gain includes an increase of more than 65% in the last 30 days. This native token of the Layer 1 blockchain platform was last seen in early April.

What is driving the rise in SUI rates?

Sui experienced a significant surge after Grayscale announced that Sui Trust is now open to accredited investors.

The daily SUI volume increased after the news, and the price followed, reaching levels above $1.

Sui's price rally above $1.67 has been linked to a significant increase in the total price locked in various decentralized financial protocols in the Sui ecosystem. OKX Ventures noted that Greyscale Sui Trust has increased market credibility for SUI as institutional interest is emerging.

Sui TVL reached 1.3 billion dollars

The bullishness surrounding this view is reflected in chain activity as TVL hits $1.34 billion.

According to DeFillama, Sui's TVL rose from about $250 million in early 2024 to $1 billion in May. However, it dropped to $462 million on August 5 amid the cryptocurrency market crash that pushed Bitcoin's price below $50,000.

The increase to $1 billion and the increase to $1.34 billion in less than a month is noteworthy. That's more than 377% year-to-date and 47% month-to-date.

Sui's growing DeFi ecosystem behind this growth includes the development of lending, decentralized exchanges, real-world assets, derivatives, and leveraged protocols.

Navi Protocol saw TVL increase 34% month-over-day to over $449 million.

Credit protocols Scallop and Suilend have TVL readings of $246 million and $203 million, respectively. It represents a 34% and 100% MTD spike, respectively.