The largest US pension problems as a strategy purchase from $ 144 million to $ 80 million

key atways

Due to price machines, MSTR fell from $ 144 million to $ 80 million. Strategic stock picking is tied to Bitcoin volatility and broader market conditions.

Share this article

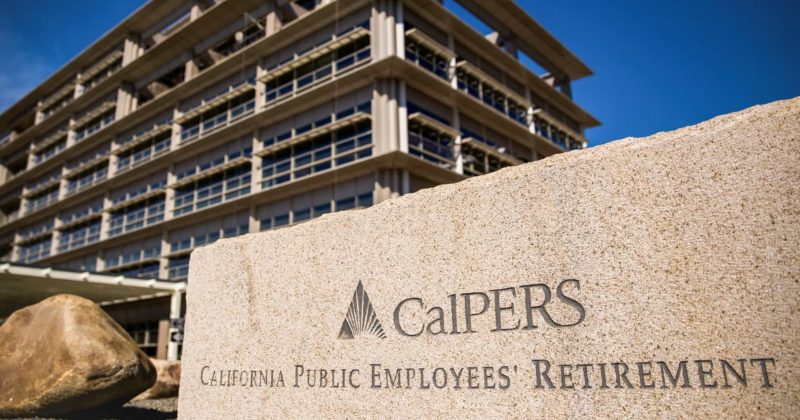

The California Public Employees' Retirement System (CARES), the largest public pension fund in America by assets, saw a pile in the first exposure to the strategy (MSTR).

It acquired 448,157 MSSRA shares worth more than $144 million in the third quarter, according to its latest filing. His position is now worth 80 million dollars.

However, the investment represents the total portfolio of investors. The fund, as of the latest data, supports more than 550 billion dollars in assets.

Strategy stock closed at about $175 on Wednesday and is down this far this quarter. MSTRE MSTR shows MSTCIN's recent growth and risk factors.

In addition, the warning from Japmogagan associated with Japmogagan was revealed by the major benchmarks that have been rotating recently.

Japmogan carries out common shares and options positions with the harmful call.