Top Analyst Explains Why He Buys These 5 Altcoins

During the approval of Ethereum exchange-traded funds (ETFs), senior analyst Michael van de Pop predicts a bullish and high profit on five unique altcoins.

This remarkable event sparked interest in the Ethereum ecosystem, setting the stage for the altcoin era. Here's a look at the altcoins Van de Pop is trying to buy, each chosen for their potential to generate significant profits.

1. Optimism (OP)

Optimism, a Layer-2 scaling solution for Ethereum, is the first altcoin on the list. As the price of Ethereum increases, platforms that increase its efficiency are expected to grow.

This Layer-2 network uses layered technology to hide transactions, reduce costs, and increase speed. Michael van de Pop highlighted the Total Value Locked (TVL) ratio, which indicates strong ecosystem growth. Optimum's low blood supply further increases the visual acuity.

“I think a coin like Optimistic can do between 300% and 800% of the BTC price in the next six months. I think that's very possible and that's probably the first run,” Van de Pop said.

2. Arbitration (ARB)

Next up is Arbitrum, another Layer-2 solution that closely competes with Optisism. It uses zero-knowledge aggregation that provides a fast and secure transaction process.

Despite the price struggle, the Arbitrum ecosystem shows strong growth momentum. Van de Pop believes its high TVL and continued growth make it a solid investment, poised for a major rebound.

“If you look at the TVL of this Arbitrum, it's almost the same as the market capitalization. That's brilliant as the ecosystem continues to grow. But after looking at the price action, it's rubbish,” van de Pop added.

Read more: 11 Cryptos to Add to Your Portfolio Ahead of the Altcoin Phase

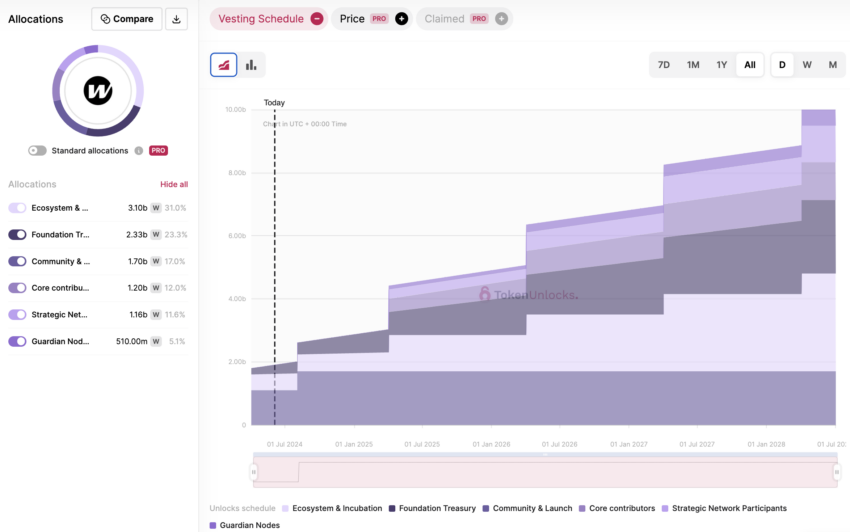

3. Woo Network (WOO)

Woo Network, a decentralized exchange (DEX) known for its high liquidity and low fees, is another altcoin Van de Pop plans to buy.

In the decentralized finance (DeFi) sector, DEXs are on the rise as regulatory pressures on centralized exchanges increase. Woo Network's technological advantages and growing user base bodes well for growth, especially as transaction volume on Ethereum increases.

Once Ethereum starts doing well and the volume has already woken up, this is where the WOO comes in. Income is also being generated so I think it's great to have. I think it could be 500% to 1,500% when the whole cycle starts for WOO,” Van de Pop explained.

4. Wormhole (W)

Wormhole, a bridging protocol for interoperability between blockchains, ranks fourth. As the DeFi landscape expands, seamless asset transfers across different blockchains are critical.

Its innovative solutions facilitate cross-chain communication, making it an attractive investment. Although relatively new, the potential for widespread adoption and integration into various blockchain ecosystems is high.

“I want to bet on Solana (SOL) solutions. The only difficult part in Wormhole is that they are still open, but these openings are going to take some time, so I think this will work very well,” Van de Pop added.

5. Dogecoin (DOGE)

Finally, Dogecoin, the popular meme coin, remains popular. Despite its volatility, Dogecoin's community support and recent price performance make it a viable short-term play.

Michael van de Pop considers it a high-risk, high-reward asset, especially amid the boom in the broader crypto market.

“Like it or not, you'll see that all meme coins are doing well. Floki, meme book, bonk. All of these meme coins are in good condition. This is when you want to get yourself into the Dogecoin space. It's the easiest. It does 4x to 5x or maybe even more,” Van de Pop said.

Read more: 7 Hot Meme Coins and Altcoins Trending in 2024

These altcoins are selected based on their technological strength, market position and potential for high profits. However, given the volatility of the cryptocurrency market, it is important to approach these investments with caution.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.