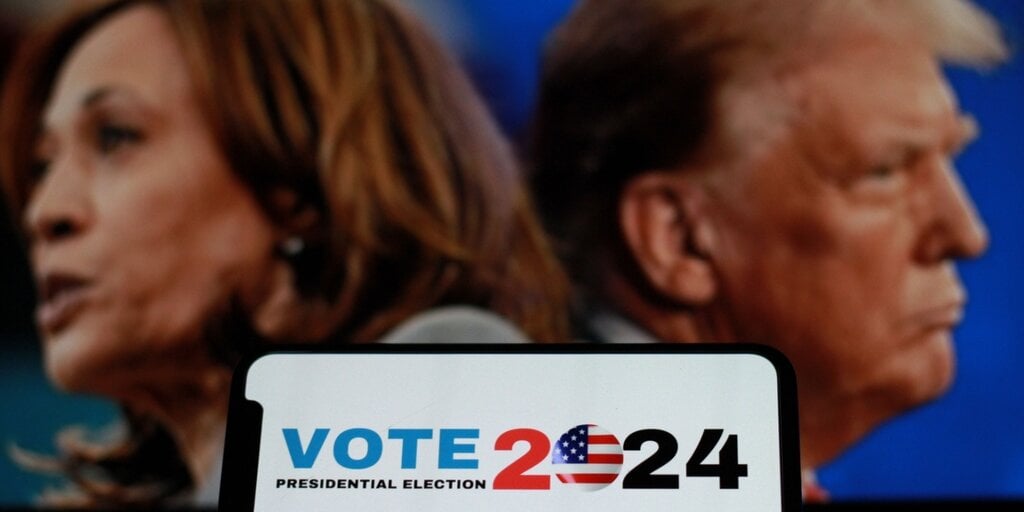

Algorithmic trading company Wintermuth has announced that it will initially focus on the 2024 US presidential election, a decentralized prediction market platform that is tied to candidates Donald Trump and Kamala Harris.

Starting next week, the platform will allow users to participate directly in the entire forecast markets Ethereum (ETH) and its layer-2 quantum networks basis And DecisionAnd it eliminates the need to link assets between chains.

The resulting market platform will be powered by decentralized applications (Dapps) powered by permissionless smart contracts – meaning any trading venue can list its tokens without incurring transaction and transaction fees.

basis For Wintermut CEO Evgeny Gaevoi, the platform aims to create a more accessible and efficient market by lowering barriers to entry. The initial token offering will feature TRUMP and HARRIS, allowing users to vote on the contestants' performance in the election, as well as use decentralized finance (DeFi) tokens on multiple exchanges.

“There was a strong desire to list such prediction market terms from both centralized and decentralized trading places, but no one did it in an unauthorized way and without imposing origination or transaction fees,” he wrote.

The platform uses Chaos Labs' Edge Proofs Oracle to ensure the integrity and reliability of data on its chains. Several trading venues, including Bebop, WOO X, and Backpack, have decided to list Outcome Market tokens.

Political meme coins and prediction markets have gained a lot of attention in recent years, combining cryptocurrency speculation with political prediction. In 2020, the FTX derivatives exchange He started the same prediction markets A highly traded US presidential election. FTX, of course, then He was accused of fraud.

Prediction markets like PredictIt and Polymarket He faced regulatory scrutiny with Polymarket. Paying 1.4 million dollars Civil monetary penalty in 2022 to settle CFTC charges. Mainly due to the demand for selection betting pools, Polymarket has increased in popularity and trading volume in 2024.

Edited by Andrew Hayward.

Daily Debrief Newspaper

Start every day with top news stories, plus original features, podcasts, videos and more.