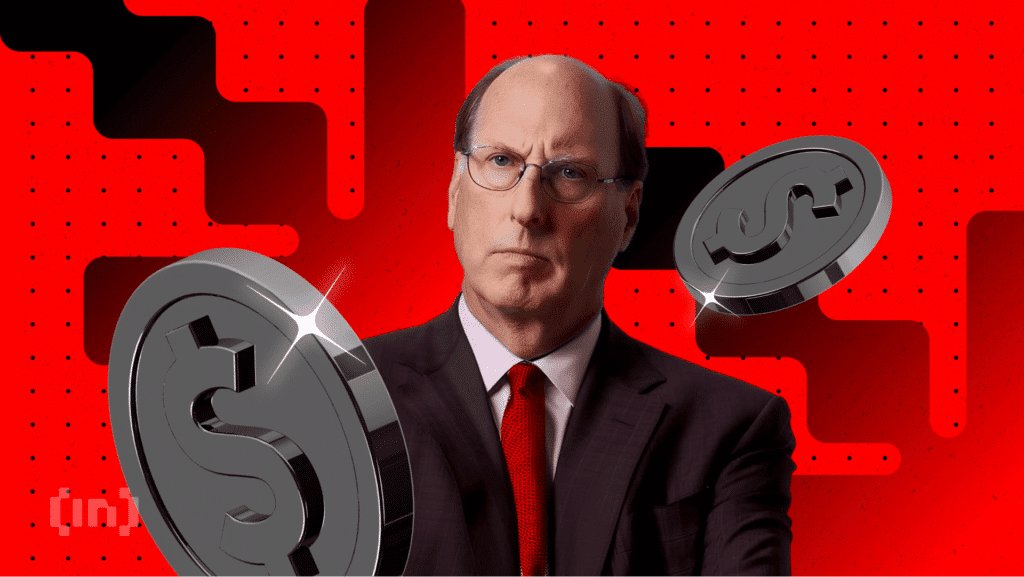

Will Bitcoin reach $700,000? Blackrock weighs in.

BlackRock CEO Larry Fink discussed the potential for Bitcoin (BTC) to reach $500,000, $600,000 or $700,000 per coin.

He explained how institutional adoption can have a significant impact on Bitcoin's price, suggesting that investors allocating even a small portion of their portfolios to Bitcoin could propel the cryptocurrency to higher levels.

BlackRock CEO Bitcoin Prediction

In an interview with Bloomberg at the World Economic Forum in Davos, Fink discussed one of the most pressing issues for Bitcoin. He saw a recent discussion with a sovereign wealth fund where the topic of Bitcoin allocation was raised.

“I was with a sovereign wealth fund this week and the conversation was: ‘Should we have a 2% allocation, should we have a 5% allocation? If everyone accepts that discussion, it will be $500,000, $600,000, $700,000 in Bitcoin,'” Fink said.

However, Fink was quick to clarify that he is not directly promoting Bitcoin.

“By the way, I'm not promoting. This is not my advertisement,” he added.

Fink's optimistic view on Bitcoin is in line with comments made by Coinbase CEO Brian Armstrong. It was recently predicted that Bitcoin could eventually reach the value of several million dollars.

BlackRock's CEO explains crypto's role in the global economy, describing it as the “currency of fear.” He explained that Bitcoin serves as an alternative for those who are worried about the deterioration of their domestic currency or the political and economic instability of their country.

“A globally-based tool called Bitcoin overcomes those local concerns,” he said.

BlackRock Bitcoin Strategy

In particular, BlackRock has been actively increasing its exposure to the largest cryptocurrency. In the year In 2024, the company became the first to receive a license for a Bitcoin exchange-traded fund (ETF) from the US Securities and Exchange Commission (SEC).

As part of its ETF strategy, BlackRock has been hoarding Bitcoin and is now one of the biggest cryptocurrency holders. According to the latest data, BlackRock's Bitcoin holdings stand at a staggering 569,343.23770 BTC. These holdings are worth more than $60 billion at current prices.

In fact, according to intelligence platform Arkham Intelligence, BlackRock made the largest bitcoin purchase of the year, acquiring $600 million worth of bitcoin.

That's not all. BlackRock's iShares Bitcoin Trust ETF (IBIT) is the largest Bitcoin ETF in the US market. According to data from Soso Value, it controls 2.89% of the total Bitcoin market capitalization.

Additionally, on January 22, the IBIT ETF received $344.28 million in inflows. Meanwhile, other Bitcoin ETFs experienced no inflows or negative inflows.

In addition to its US offering, BlackRock launched the iShares Bitcoin ETF in Canada on January 13, trading under the ticker symbol ‘IBIT' on Cboe Canada, expanding its Bitcoin investment strategy globally.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.